Betterview Launches PropertyNow: Unlimited Roof Condition Estimates and More in Less than a Second

Instant, high-quality data is critical for property & casualty insurance carriers, especially during the quoting process. Whether they are online...

1 min read

David Lyman

:

Jan 14, 2021 1:34:19 AM

David Lyman

:

Jan 14, 2021 1:34:19 AM

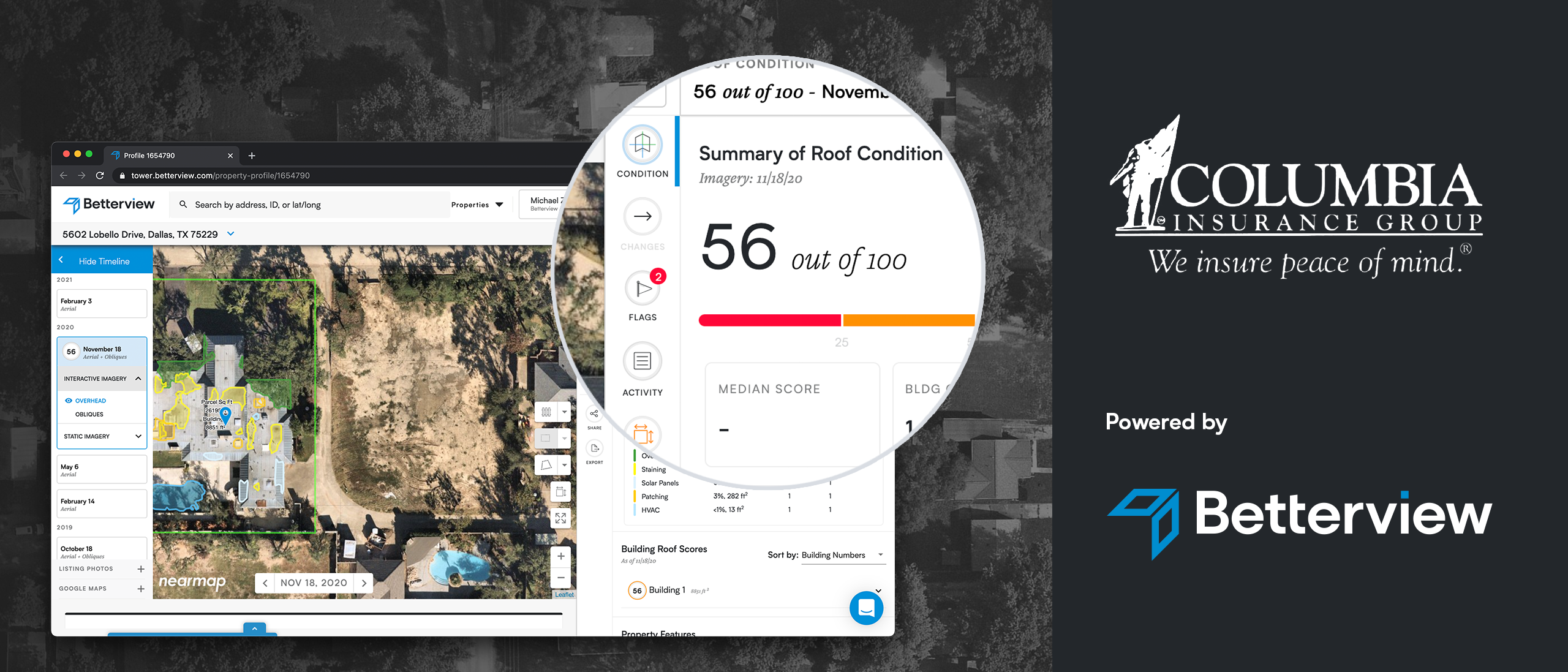

At Betterview, it’s not enough to increase efficiency and improve insurers’ results. We strive to enable our customers to provide insurance buyers with a superior customer experience. Since insurance customers and agents typically buy other products online, expectations keep rising. We have come to expect instant quotes and we are not happy if the price rises or terms change during the underwriting process.

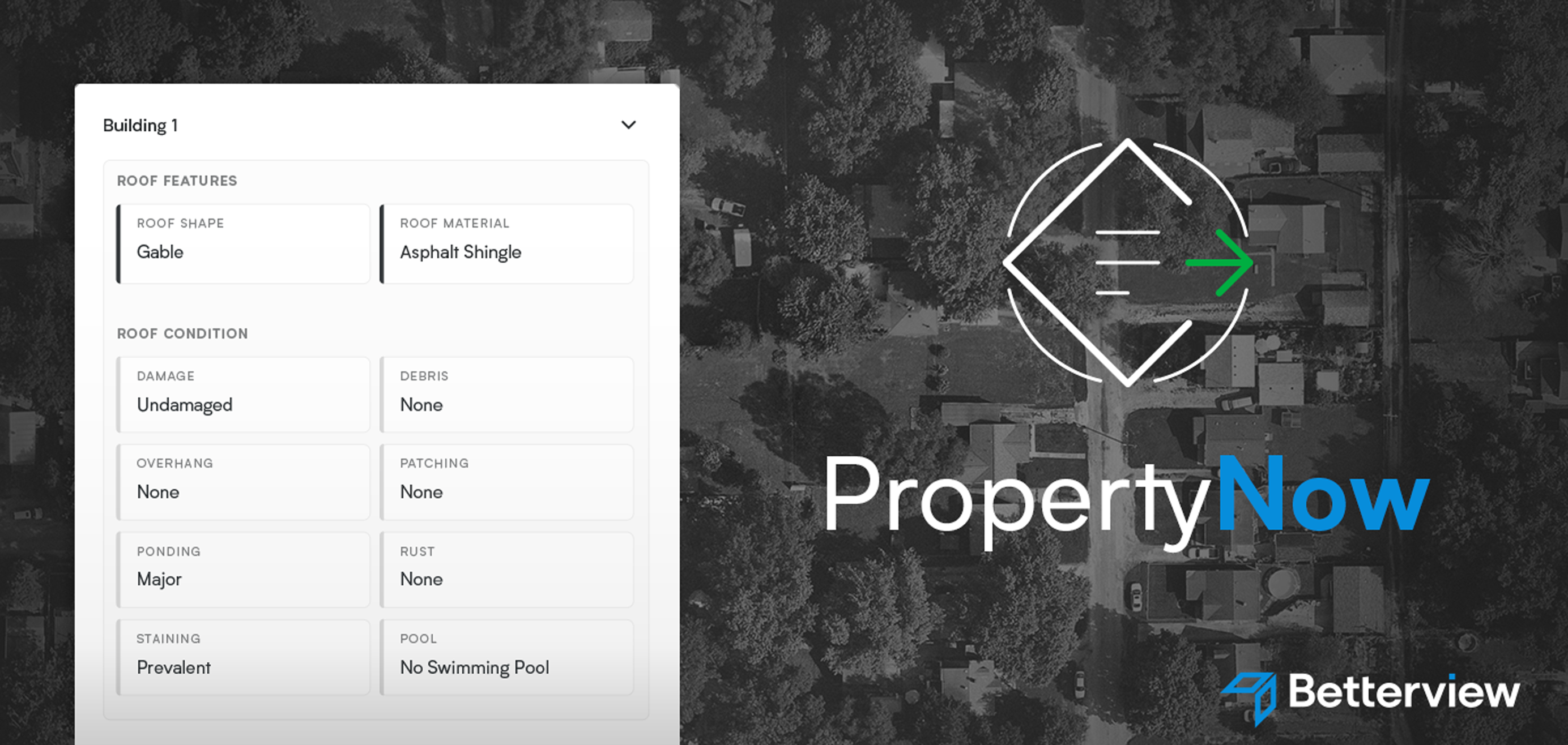

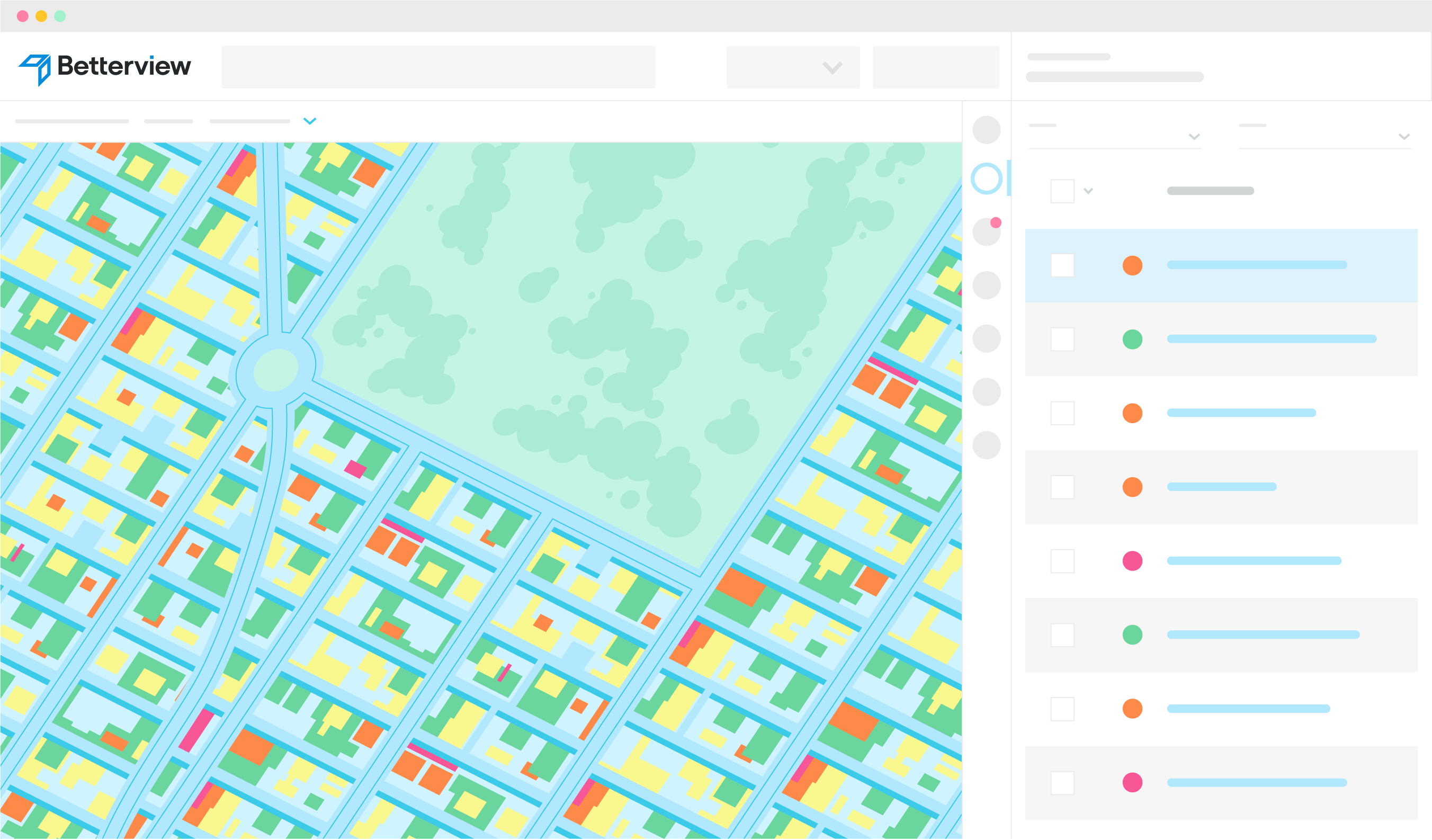

Betterview’s PropertyNow enables carriers to improve the speed and accuracy of the quoting process by providing pre-processed data for key property attributes—such as roof type, size and proximity of vegetation—for all locations across the entire United States.

PropertyNow is not just another prefill service. Having the right data when quoting also improves the customer experience by reducing the number of questions needed to properly underwrite the risk. With PropertyNow, carriers have access to the most current data on key attributes, enabling them to quote rapidly without sacrificing underwriting precision and taking on unnecessary risk.

Upon receiving a request for a quote, carriers using PropertyNow call up crucial data within a fraction of a second via API. The data is introduced into the carrier’s quote flow seamlessly, ensuring a speedy quote without sacrificing pricing accuracy. Agents and customers enjoy the convenience of a quick quote. Carriers avoid surprises resulting from incomplete data, and customers avoid unanticipated hikes in premium.

PropertyNow provides instant access to data that will enable the best pricing decision in the interest of all parties—insurer, agent and property owner. It is offered as a standalone offering, or as part of Betterview’s platform for property underwriters to visualize, analyze and act with confidence.

Instant, high-quality data is critical for property & casualty insurance carriers, especially during the quoting process. Whether they are online...

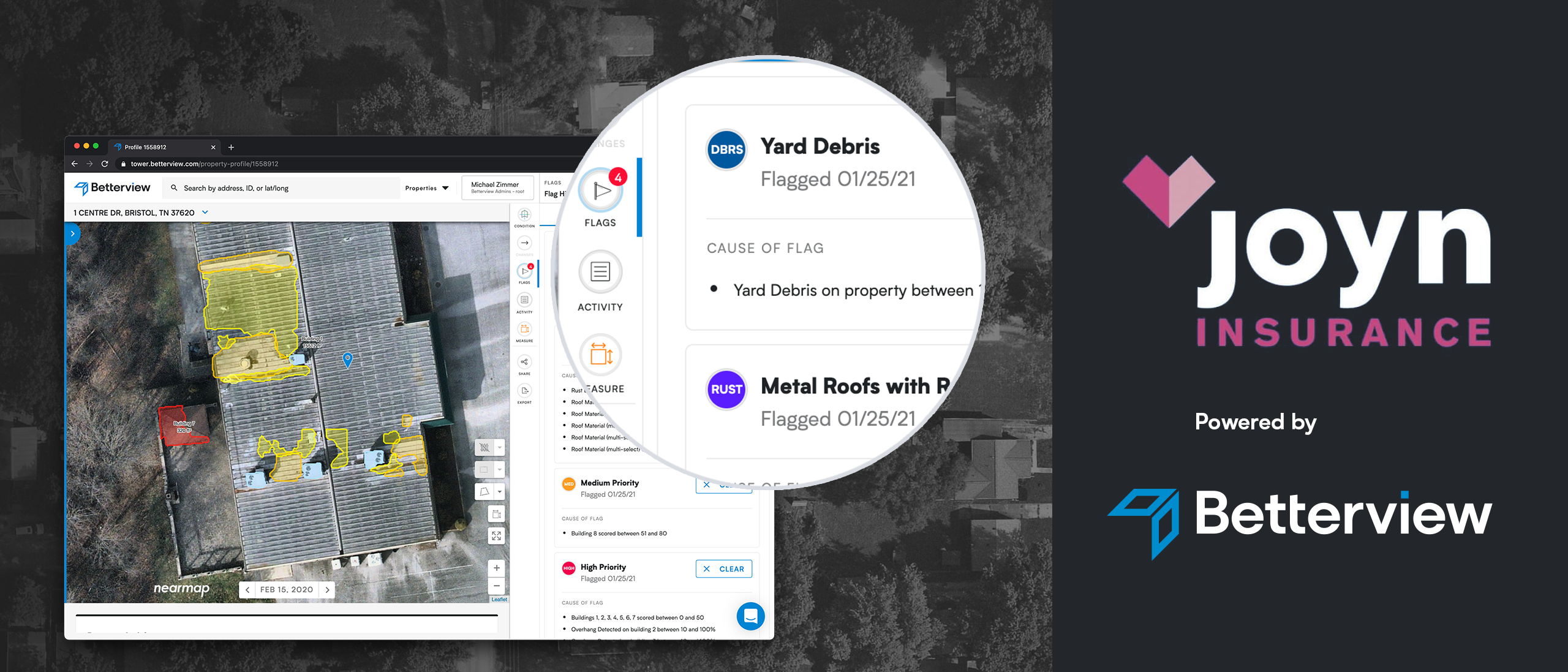

Betterview is excited to announce a partnership with Joyn Insurance, the newly formed InsurTech company focusing on the US small and mid-sized...