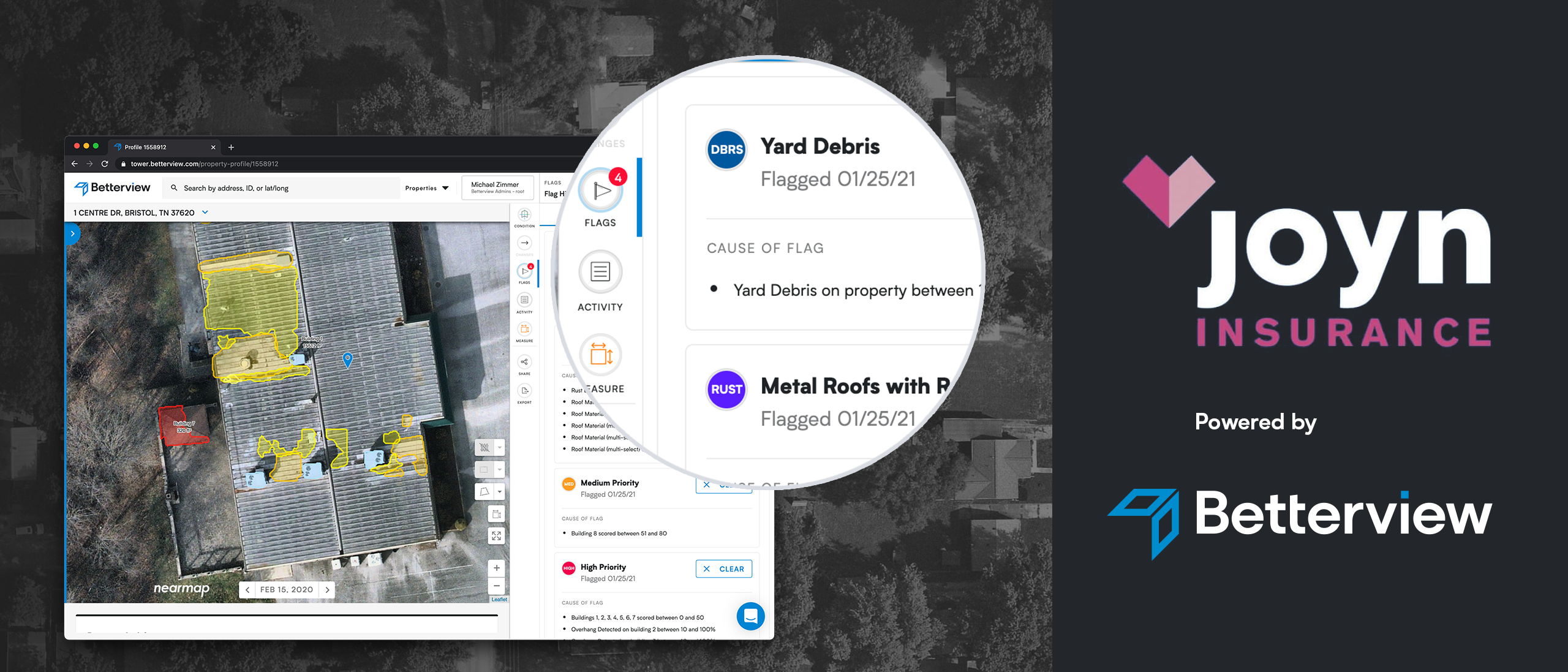

Instant, high-quality data is critical for property & casualty insurance carriers, especially during the quoting process. Whether they are online customers looking for coverage, agents, or comparative raters trying to get a quote for a new policy, people are increasingly unwilling to wait around for minutes, hours, or even days for a quote.

That is why Betterview is excited to announce the launch of PropertyNow, our fast and affordable preprocessed data offering for quotes. PropertyNow gives customers access to our 100% proprietary, AI-model-derived, pre-processed Roof Condition Estimate, and other essential rating and underwriting attributes for residential and commercial properties across the entire United States.

As part of our PropertyNow product, insurance carriers that are customers of Betterview’s enterprise software platform can now make unlimited API requests to quote new business and can expect to get results in as little as 500 milliseconds.

Robust Property Intelligence

With PropertyNow, carriers now have instant access to:

- Betterview’s 100% proprietary AI roof condition and roof attributes for over 140 million structures

- Betterview’s 100% proprietary AI property attributes across over 110 million land parcels

- Coverage of both personal and commercial properties across the entire United States

- Unlimited access to rating and underwriting variables that support a faster and more accurate quoting process

All of this data helps carriers deliver lightning-fast quotes based on actual risk drivers. Not only does this save expenses and valuable time during quoting, but it also contributes to a much more positive customer and agent experience. Modern customers expect instant quotes without sacrificing accuracy, and that is what PropertyNow provides. In addition, PropertyNow is fast enough to support the turnaround time requirements of comparative raters.

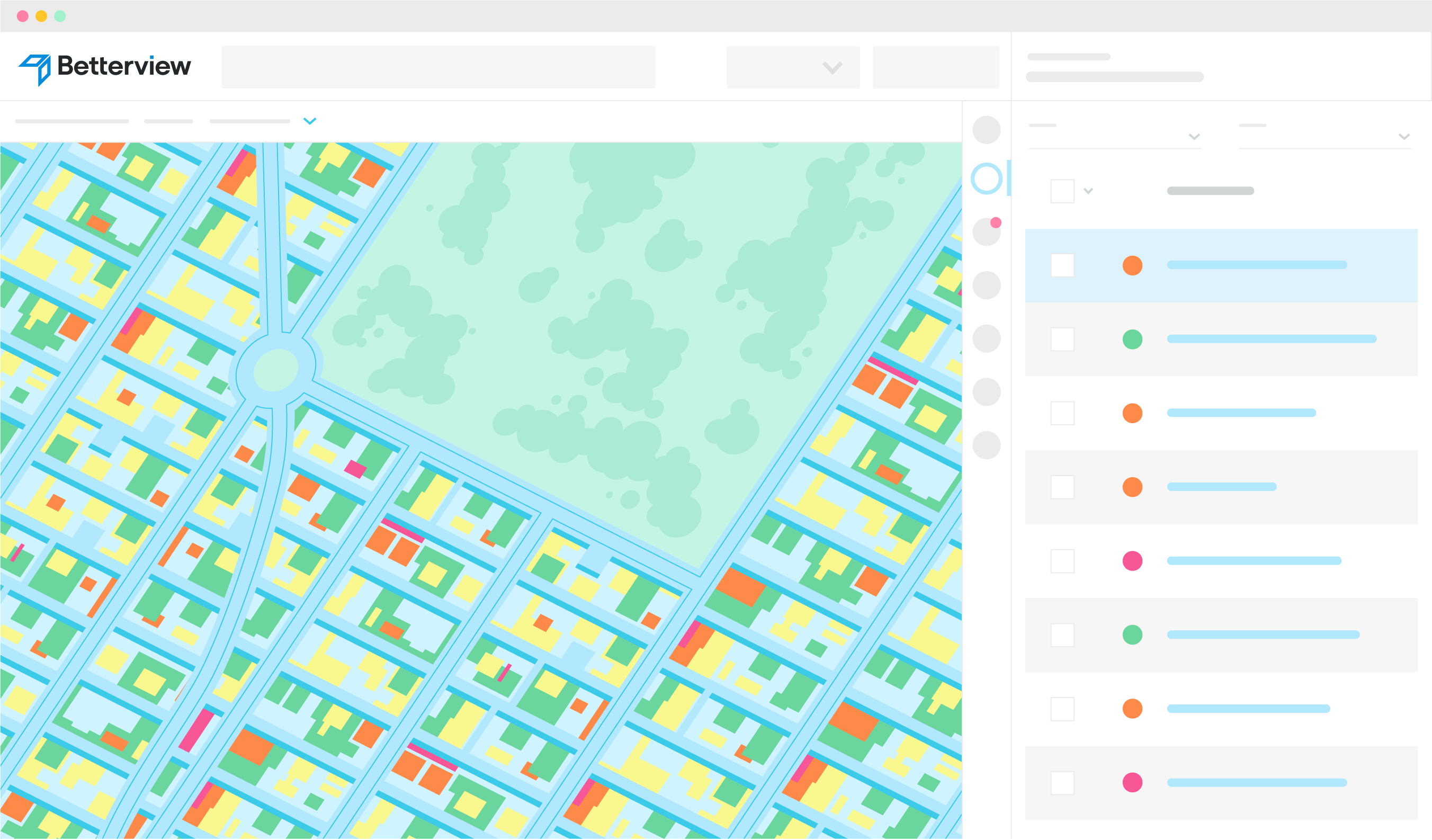

Map showing the condition of roofs based on the PropertyNow Roof Condition Estimate for every ZIP code in the US. Red areas indicate ZIP codes where there is a large percentage of low scoring roofs and green areas have mostly good roofs.

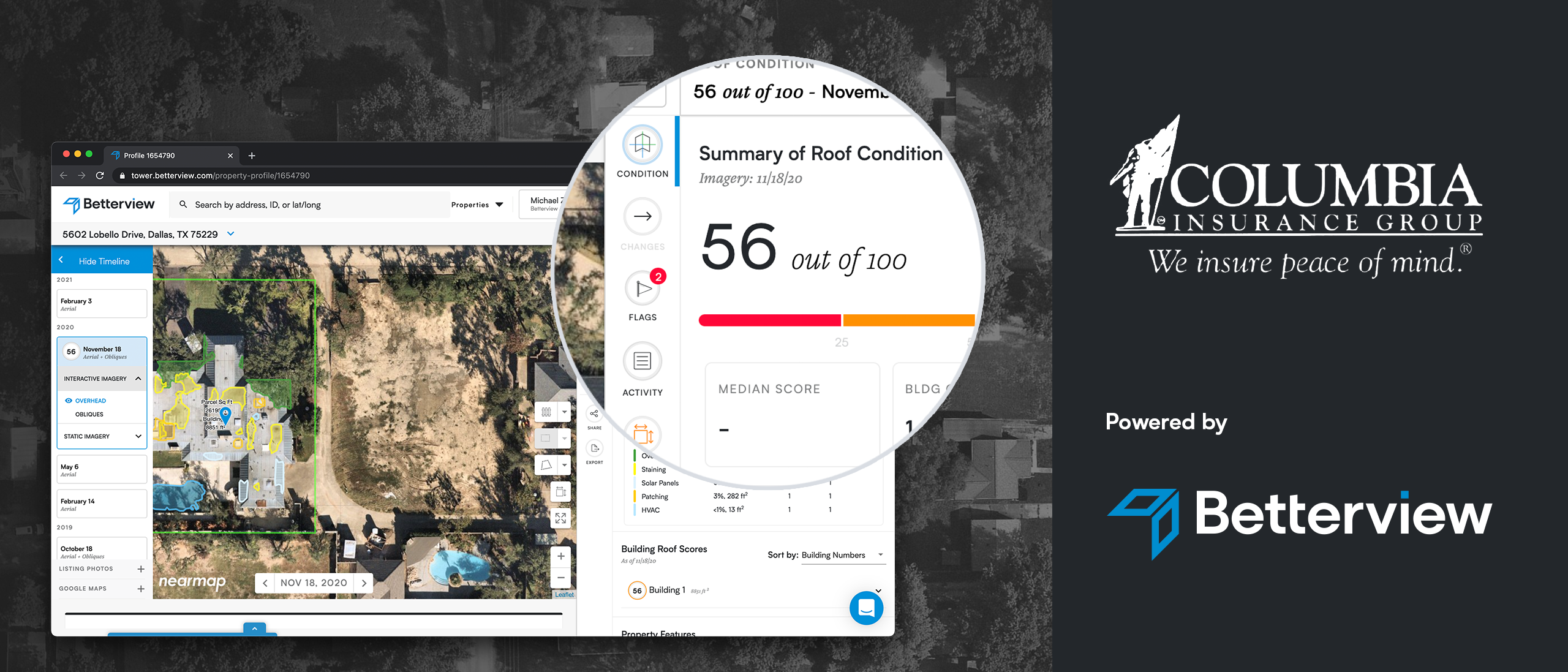

Unlimited License

PropertyNow is fast, accurate, and highly scalable. Rather than charging for each property queried, PropertyNow provides carriers with an unlimited license. That means carriers can pull instant quotes on any property, commercial or residential, anywhere in the country, as many times as needed.

Our goal at Betterview has always been to serve the real needs of carriers and their underwriters and solve the real problems they face daily. PropertyNow, like every part of our platform, will help create a smarter, faster, and more pleasant policy experience for all parties involved. As a result, expenses will go down, underwriter workflows will be streamlined, and customers will be delighted by the speed and accuracy of their quotes.

If you are interested in learning more about Betterview PropertyNow, please reach out to our team. Existing customers, please contact your Customer Success Manager. If you are a prospective customer but are not already working with someone at Betterview, please click here so that we can connect you with the appropriate member of our team who can tell you more about PropertyNow and the Betterview property intelligence platform.

Meadow Green

Meadow Green