2 min read

Betterview Partners with Joyn Insurance to Empower Underwriters

Meadow Green

:

Mar 4, 2021 1:00:14 AM

Meadow Green

:

Mar 4, 2021 1:00:14 AM

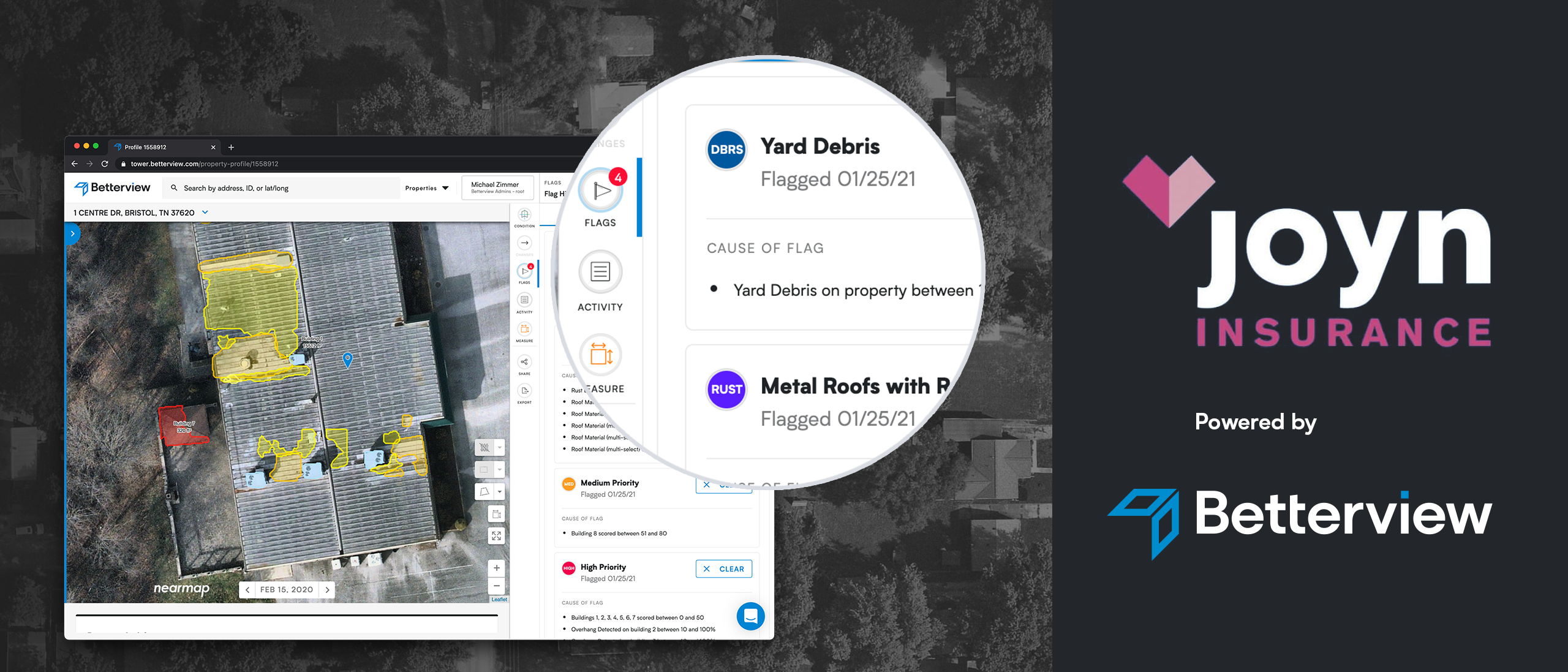

Betterview is excited to announce a partnership with Joyn Insurance, the newly formed InsurTech company focusing on the US small and mid-sized commercial market. By leveraging Betterview’s property insights and tools, Joyn will maximize the accuracy and efficiency of its underwriting process.

Betterview is excited to announce a partnership with Joyn Insurance, the newly formed InsurTech company focusing on the US small and mid-sized commercial market. By leveraging Betterview’s property insights and tools, Joyn will maximize the accuracy and efficiency of its underwriting process.

David Tobias, Betterview’s co-founder and COO, is excited to add Joyn to the company’s growing list of partners. “We’re delighted to partner with Joyn Insurance as they gear up to launch their new programs tailored to the needs of small and medium-sized businesses,” he says. “By leveraging our platform, they will be able to generate faster quotes, provide more accurate coverage, and deliver an enhanced experience to agents and their customers.”

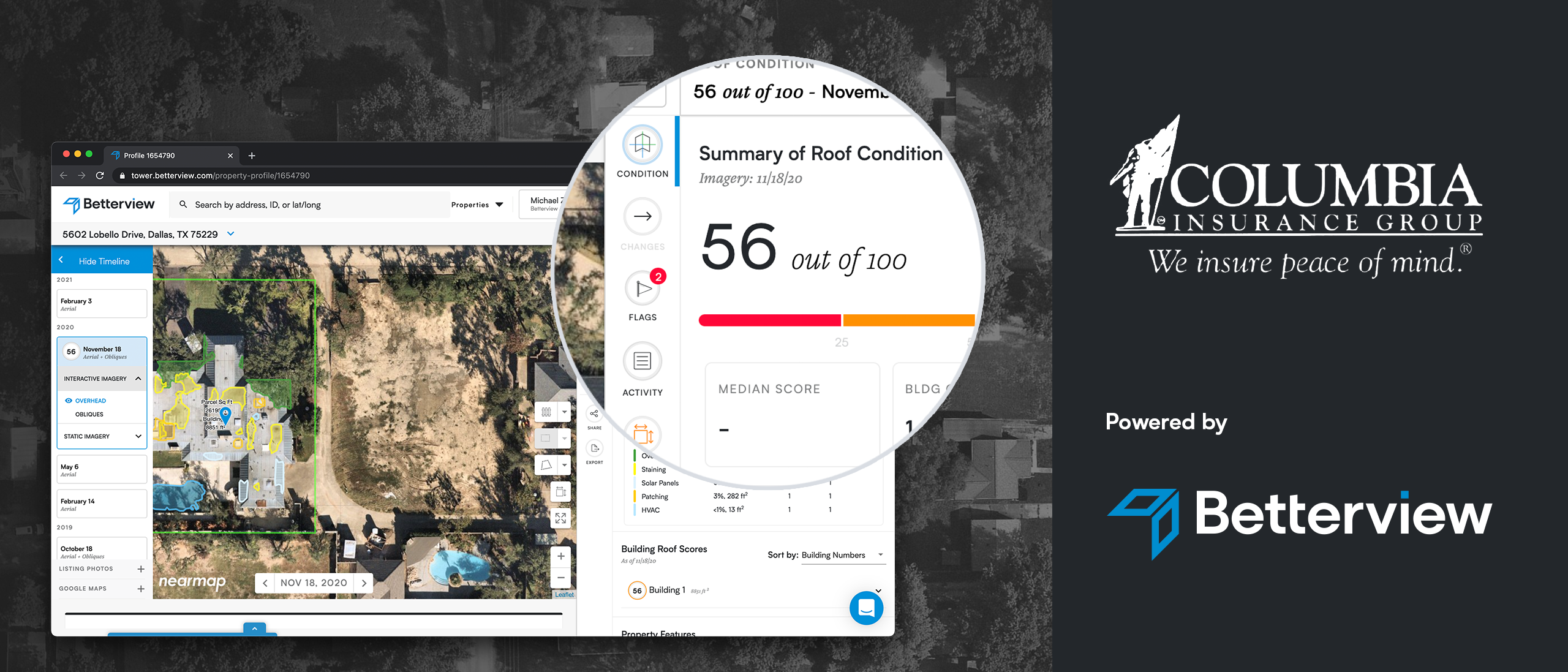

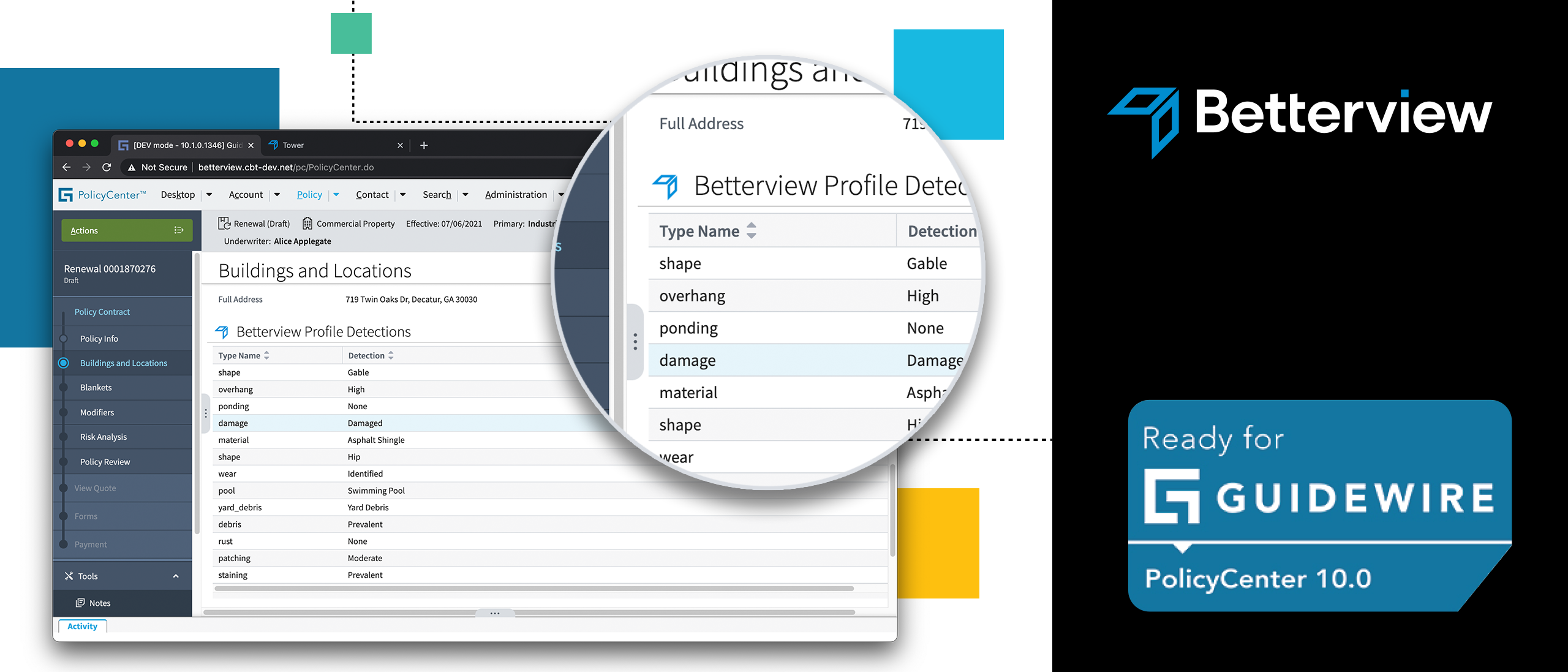

Betterview’s platform is designed to inform and empower P&C insurance companies at every stage of the policy life-cycle. For underwriters like those at Joyn, the tool is particularly indispensable. Using a combination of first-party aerial imagery and third-party data from our trusted PartnerHub, Betterview generates computer vision-driven insights on a property at sub-second speeds. Underwriters are given access to a comprehensive breakdown of a property’s risk profile, including a Roof Condition Score and other common premium and loss-drivers. They can then flag properties that require extra attention and fast track solid risks – all integrated seamlessly into their workflows to ensure an optimal experience.

By partnering with Betterview, companies like Joyn can streamline their underwriting process while still trusting in the accuracy and intelligence of their quotes. Ed Pulkstenis, Chief Underwriting Officer at Joyn, recognizes the benefits this partnership provides. “Our partnership with Betterview allows our underwriters to be better informed about applicants’ property exposures and risk profiles,” he says, “as well as to provide timely quotes and policies.”

In order to compete in an increasingly automated, disruptive marketplace, more and more P&C insurance companies are partnering with technology providers like Betterview. The relationship between cutting-edge, data-driven technology platforms and the traditional insurance industry can and should be a mutually beneficial one. Both Betterview and Joyn Insurance are looking forward to a fruitful relationship moving forward.

About Betterview

Betterview was founded with the mission of helping P&C carriers better identify and manage property risk. It was created with a deep, first-hand understanding of the challenges that carriers have faced in obtaining high-quality, actionable insight. Betterview’s remote property intelligence platform enables carriers to provide a better experience to their insureds and agents while improving their bottom line. If you want to leverage Betterview to streamline your underwriting process – or you just want to learn more about our platform – contact us today.

About Joyn Insurance

Joyn Insurance is a newly formed InsurTech that will be underwriting commercial insurance in the small and middle markets. Anticipating market entry in spring 2021, Joyn will be powered by technology, data and expertise to deliver a transparent and trusted experience to brokers and customers.

Betterview Launches New Accelerator on the Guidewire Marketplace

Betterview: A Diamond in the Rough

Betterview: A Diamond in the Rough By Brian Desmond, Guidewire CMO, Betterview Board Member