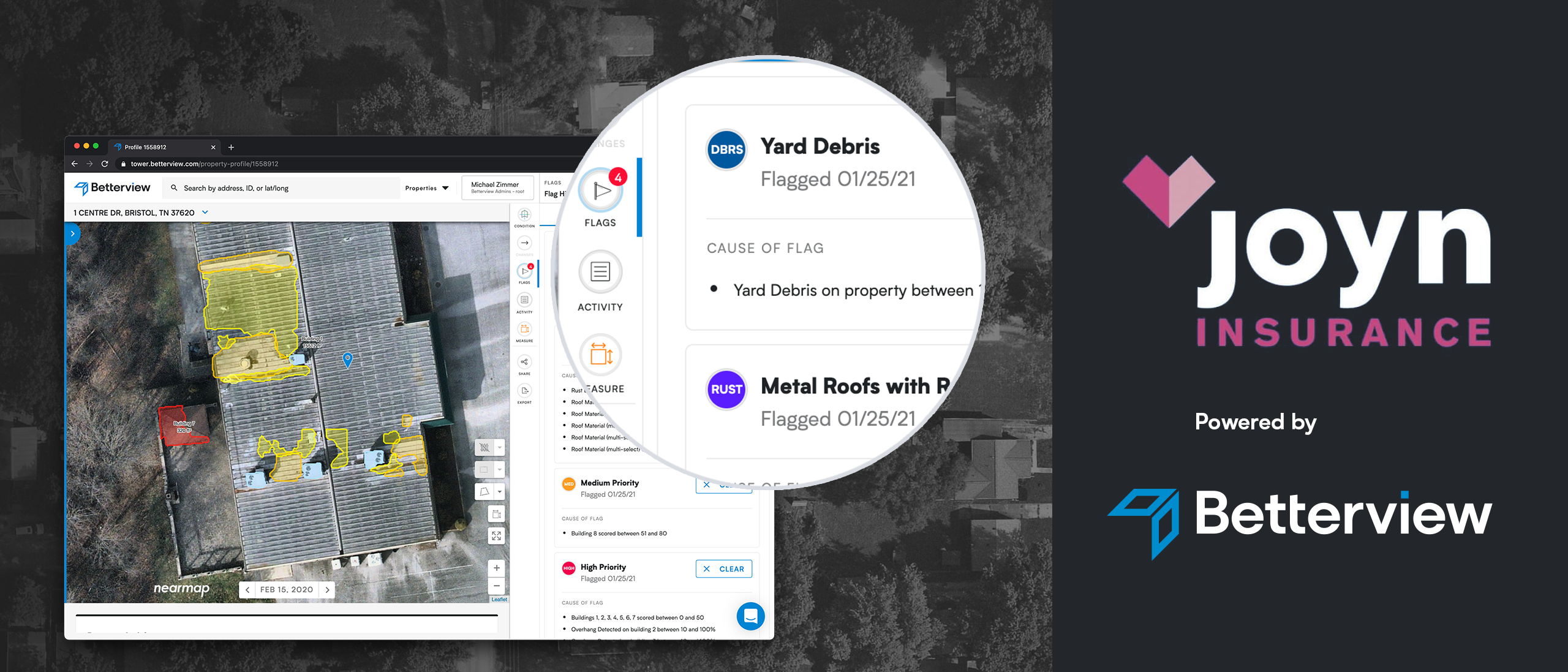

Betterview Partners with Joyn Insurance to Empower Underwriters

Betterview is excited to announce a partnership with Joyn Insurance, the newly formed InsurTech company focusing on the US small and mid-sized...

2 min read

Meadow Green

:

Mar 11, 2021 3:52:45 AM

Meadow Green

:

Mar 11, 2021 3:52:45 AM

Betterview is excited to announce a new partnership with Columbia Insurance Group, a P&C insurance carrier providing a full range of coverage for small businesses across 14 states. By leveraging Betterview’s platform to streamline their underwriting processes, Columbia joins the bleeding edge of the Insurtech industry.

David Tobias, Betterview’s co-founder and COO, is thrilled to add Columbia to the company’s growing list of partners. In particular, he is happy to turn a longstanding professional relationship into an official business partnership. “Our companies have been in contact for a long time,” says Tobias. “Columbia has watched us grow, and we couldn’t be happier to be formally working together starting today.”

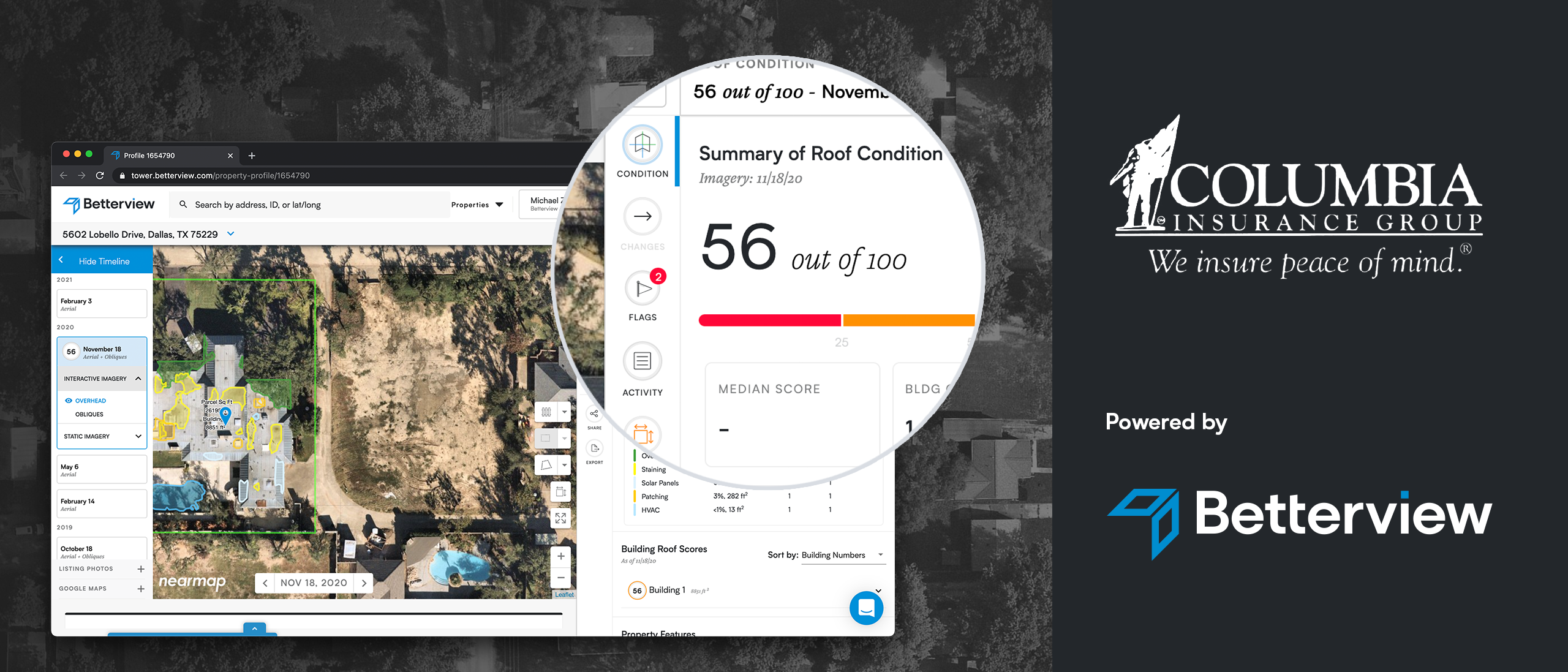

By signing on with Betterview, Columbia Insurance Group gains access to a suite of tools built to maximize the accuracy and efficiency of their underwriting processes. Using a combination of first-party aerial imagery and third-party data from our trusted PartnerHub, Betterview generates computer vision-driven insights on a property at sub-second speeds. Underwriters are given access to a comprehensive breakdown of a property’s risk profile, including a Roof Condition Score and other common premium and loss-drivers. They can then flag properties that require extra attention and fast track solid risks – all integrated seamlessly into their workflows to ensure an optimal experience.

Among Betterview’s myriad offerings, the team at Columbia is particularly excited about the insights the platform can give them into roof condition. “The Roof Scoring tool is very useful for us,” says Scott Mackey, SVP and Chief Underwriting Officer at Columbia. “Roofs can age out of sight for years, but Betterview’s technology helps our underwriters automate their review and response process, especially for policy renewals.” The Roof Condition Score is a popular feature among many Betterview customers, providing a quantified breakdown of how a roof can contribute to overall property risk.

In order to compete in an increasingly automated, disruptive marketplace, more and more P&C insurance companies are partnering with technology providers like Betterview. By partnering, Betterview and Columbia Insurance Group are both recognizing that collaboration – and not competition – is the best strategy for the industry moving forward.

Betterview was founded with the mission of helping P&C carriers better identify and manage property risk. It was created with a deep, first-hand understanding of the challenges that carriers have faced in obtaining high-quality, actionable insight. Betterview’s remote property intelligence platform enables carriers to provide a better experience to their insureds and agents while improving their bottom line. To learn more about how Betterview can maximize the efficiency and accuracy of your underwriters, contact us today.

Founded in 1889, Columbia Insurance Group is a regional property/casualty mutual insurer focused on providing risk management and insurance solutions for small and mid-sized businesses. CIG markets those solutions exclusively through its network of independent insurance agencies in its 14-state marketing territory. CIG is rated A- “Excellent” by A.M. Best.

Betterview is excited to announce a partnership with Joyn Insurance, the newly formed InsurTech company focusing on the US small and mid-sized...

Betterview is proud to announce the launch of PartnerHub, the latest addition to our Remote Property Intelligence Platform. New and existing...