Why Do Partnerships Matter at Betterview?

When I was first hired at Betterview, it was in part due to my experience as a flight instructor. Co-founders Dave Tobias and David Lyman had an idea...

4 min read

Meadow Green

:

Oct 1, 2021 4:08:56 AM

Meadow Green

:

Oct 1, 2021 4:08:56 AM

Betterview is proud to announce the launch of PartnerHub, the latest addition to our Remote Property Intelligence Platform. New and existing customers now have access to third-party property data directly in the Betterview software platform for automating workflows and viewing detailed information about specific properties of interest. With PartnerHub, insurers can further automate workflows and empower their employees to make more informed decisions through instant access to geospatial, weather, firmographic, and other relevant sources of data.

Insurance companies need a lot of data in order to make the most informed decisions for every property in their book, including high-quality property intelligence. This means data on the condition of the property itself, but also data about local weather conditions, building permits, tax assessor’s records, and other relevant information. Accessing this data is only the beginning. Insurers also need a tool that can transform all of these disparate resources into direct policy recommendations.

For example: An insurer that is using the Betterview platform wants to run renewals on a large book of properties. They know that plenty of these properties are in fine shape and can be auto-renewed, but they want to determine which ones require further inspection.

Over the past few years, most of Betterview’s customers have been using Betterview’s proprietary data in tandem with intelligence sourced from other great companies like e2Value, Canopy Weather, and RedZone. However, adding third-party data to the platform has historically required time, labor, and IT resources from the carriers themselves. The process of writing API connections to integrate partner data into Betterview workflows is not always an easy one. PartnerHub does all of that legwork for the carriers, giving them the advantage of fully integrated third-party property data without any additional effort on their part. Like every feature of the Betterview platform, PartnerHub enables underwriters to make more informed and effective decisions around property risk, while simultaneously streamlining the efficiency of their workflows at a great total cost of ownership (TCO).

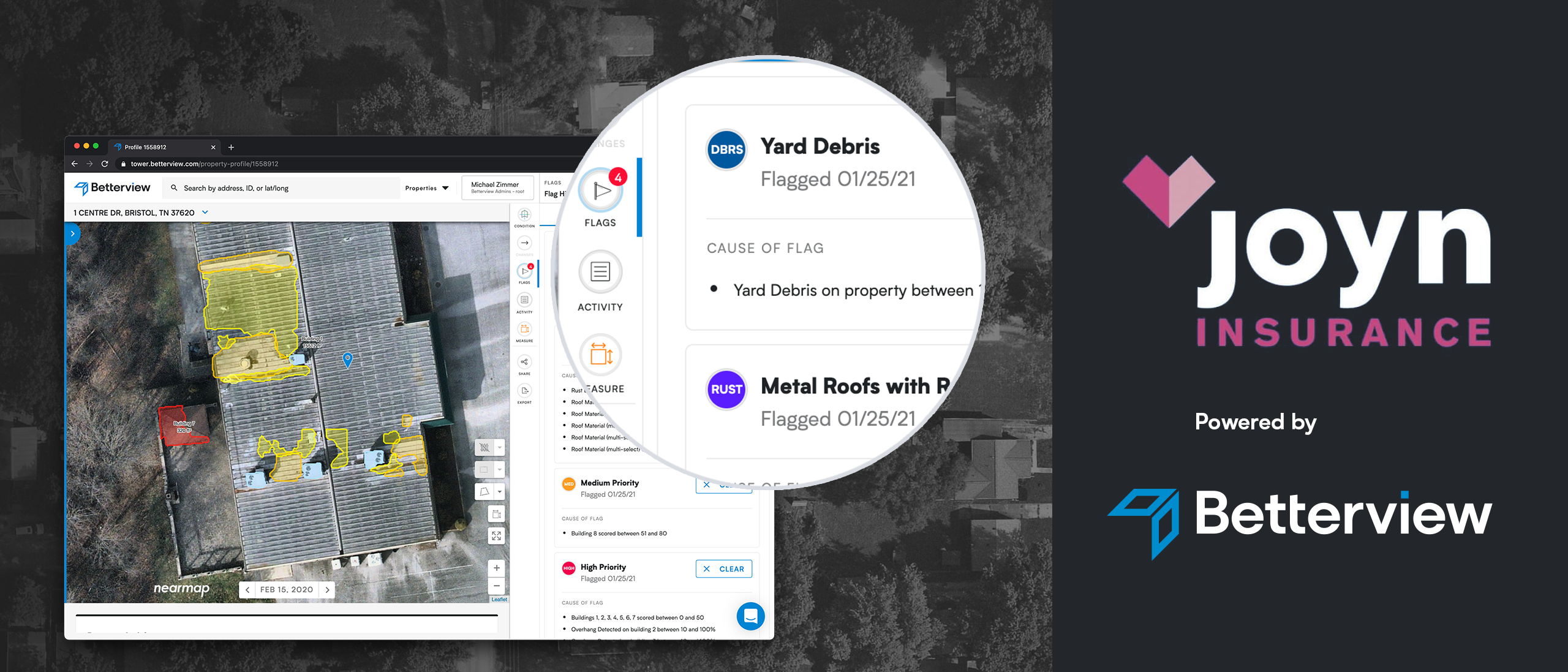

PartnerHub does more than simply migrate diverse sources of data into a single-screen platform. It goes further, combining this data with Betterview’s own property intelligence, policy data provided by carriers themselves, like premium, renewal date, loss history, and more. By synthesizing all three of these data sources, the Betterview platform is able to create the most comprehensive risk profile of commercial and residential properties in the insurtech marketplace. Insurers can act directly on this combined property intelligence, even using it to create custom business rules in PropertyAction, Betterview’s flagging engine. PartnerHub further exemplifies the Betterview mission of transforming data into action to help insurers build smarter workflows, improve their combined ratio, and provide a better customer experience.

By turning multiple sources of data into a single, intuitive, interface, PartnerHub furthers the Betterview mission of streamlining workflows for Property & Casualty insurers while empowering them to make better decisions. It makes the Betterview platform more capable, flexible, and transparent.

At its heart, PartnerHub expands on the central function of the Betterview platform: to transform property data into direct underwriter action. It accomplishes this by connecting the powerful Betterview platform with equally powerful data providers. Betterview has worked with some of these partners for many years, building strong relationships based on mutual trust and admiration for each company’s respective expertise. We know that we are not going to be able to provide better peril data than HazardHub, or better property valuation data than e2Value. Rather than reinventing the wheel, we have opted to partner with these companies and deliver the advantages straight to our customers.

Every P&C insurer uses the Betterview platform differently, often requiring different data sets in combination with each other. PartnerHub makes it simple to pick and choose exactly what data is used to power every decision, from new business to claims to renewal. Customers can choose a-la-carte property intelligence from a wide range of providers, trusting Betterview to write the API connections to seamlessly integrate the necessary data. With our configurable UI, partners will only see the data that is most relevant to their specific needs. And for those that want even more control over the experience, they will have access to the partner’s full data graph and can even edit the UI to ensure that their view of the data is suited to their specific use case.

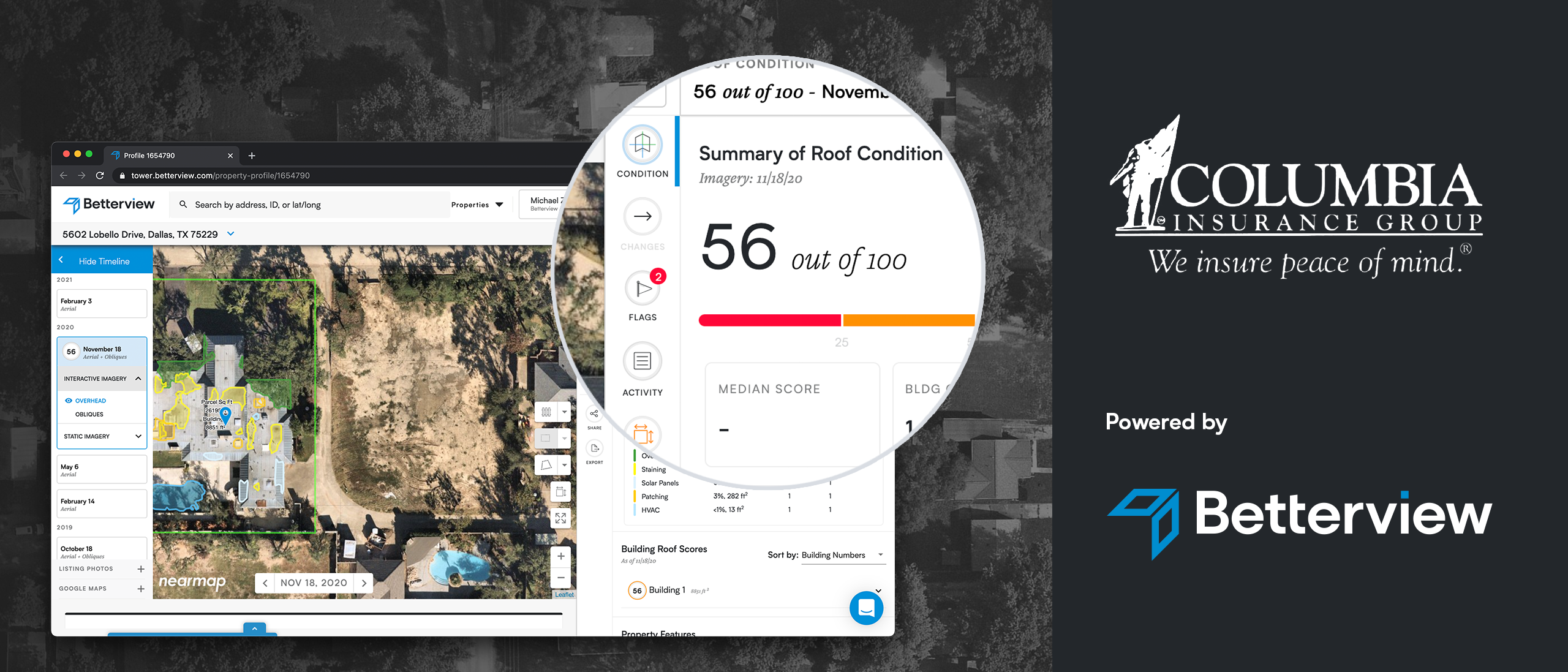

Betterview has always been powered by strong partnerships with best-in-class data providers across the industry. All of the actionable insights we deliver to customers – including our 100-point Roof Spotlight Index, the most comprehensive score of roof condition in the insurance industry – are built on the most accurate, high-quality property data available. The addition of PartnerHub into our UI will give customers a full view of the data that is powering each decision they make in our platform, and from where that data is sourced. Not only does PartnerHub improve the quality of data carriers can use to make policy decisions; it also provides them with full transparency so they can always know which data is informing their processes.

Data providers featured on PartnerHub include, but are not limited to:

The Betterview platform is designed to serve the complex, ever-evolving needs of P&C insurance underwriters; for that reason, we will never stop refining and improving it. PartnerHub represents a significant transformation in the strength of our platform. Without any additional effort on the part of our users, they are now able to instantly leverage property data from a diverse range of third-party partners. This data can be combined with other sources – public, private, and commercial – and seamlessly integrated into the already-robust capabilities of the Betterview platform, such as PropertyAction, our customizable flagging tool. PartnerHub dramatically expands the ability of the Betterview platform to transform property data into direct underwriting action; and it does so while still reducing underwriting expenses and time. At Betterview, we know that improvement is an ongoing process. We will continue to unveil new features that make our platform more powerful and enable P&C insurers to build stronger, smarter, and more efficient processes.

When I was first hired at Betterview, it was in part due to my experience as a flight instructor. Co-founders Dave Tobias and David Lyman had an idea...

Betterview is excited to announce a partnership with Joyn Insurance, the newly formed InsurTech company focusing on the US small and mid-sized...