How to Tackle P&C Rating in 2024

How can insurers rate more effectively when property condition across the US is changing more frequently than ever? This is a significant challenge ...

4 min read

Dave Tobias

:

Feb 13, 2024 7:30:00 AM

Dave Tobias

:

Feb 13, 2024 7:30:00 AM

What are the key trends challenging P&C insurers in 2024?

In collaboration with our customers, we have identified three primary trends posing challenges to P&C insurers in 2024: inflation, demographic shifts, and climate change. To delve deeper, presented below is a panel discussion I led at Guidewire Connections featuring three industry leaders—also our customers—who are at the forefront of tackling these issues.

Our panelists included Rob Jacobson, President & CEO of Rockford Mutual Insurance Company; Gerry Heare, SVP and Commercial Lines Chief Underwriting & Strategy Officer at Grange Insurance; and Zac Cosier, Technical Director of Underwriting Performance at Nationwide Insurance. The following conversation is an excerpt from our panel, aiming to explore strategies and responses to these evolving challenges. To listen to the entire discussion in its full context, please see the audio file below.

The Rise of Inflation

Dave Tobias: The current inflationary environment presents multiple challenges for companies, particularly considering the rising cost of replacement, materials, and labor. How are you managing these inflationary risks?

Rob Jacobson: The key is how we analyze our pricing strategy to stay ahead of the inflationary trends. That has been difficult because we are dealing with the time lag along with the cost of goods going up for property repairs. When there is a time lag for supply chain issues, we have to pay for the cost of loss of use or rental until the insured is back into either their commercial property or their home. All of that adds up to exasperating inflationary trends that are demonstrated in our pricing changes, and we're seeing this across the board.

Gerry Heare: I would add, in the past 18 to 24 months, our industry has placed a renewed emphasis on annual updated statements of values for agreed value, accurately reflected, especially in the context of business interruption worksheets. From an industry perspective, I believe there had been a period of leniency in these areas, but we've restored discipline around that now, a necessary shift given the current environmental challenges.

Zac Cosier: One of our most significant challenges has been adjusting to the rapid increase in material costs. Insuring properties at replacement values becomes increasingly difficult when those costs rise by 20%, 30%, or even 40% in just a few short years, directly affecting our ability to settle claims without incurring substantial additional expenses.

Demographic Shift in P&C Insurance Workforce

DT: Demographic shifts present multiple challenges for the industry. Firstly, consumer behavior is evolving; people now demand more personalized service and expect to engage with brands on their terms, favoring speed and customization. Secondly, we are facing a workforce dilemma as experienced underwriters retire and fewer newcomers enter the field, leading to a talent gap. Lastly, migration patterns are causing concern as populations increasingly relocate to areas susceptible to not just one, but multiple types of catastrophes. Addressing these shifts requires adaptability and strategic planning. How do you navigate these complex changes?

ZC: We see demographic changes are leading to increased population density and urban development in areas prone to severe weather, which were historically considered rare. What used to be 'once-in-a-century' weather events are now happening more frequently due to these shifts in migration and growth. Therefore, it is important to keep a pulse on it, leverage technology, and equip our underwriters with the tools they need to anticipate and respond to these emerging risks effectively.

DT: Gary, in any other areas that you write, are you keenly thoughtful around this?

GH: In the past three to four years, twelve states, excluding Florida, have endured the majority of severe weather incidents in the central U.S. Our company underwrites policies in eight of these states, so managing risk in these regions is a constant concern for us. We proactively consider various strategies to mitigate exposure and minimize potential losses, although it remains a significant challenge.

DT: In some of the states where you underwrite, you are contending with wind and hail perils, right, Rob?

RJ: Yes, absolutely. The state of Illinois, my largest state by far, averages 55 tornadoes annually. Astoundingly, this past March had 71 tornadoes in a single day, and to date, there have been 159. Such data underscore the reality of climate change—If anybody says otherwise, come to Illinois.

Climate Change and Increased Storm Activity

DT: That is a great segue, Rob. Years ago, when we started Betterview, I would often say to people, “Every carrier is a catastrophe carrier.” Unfortunately, that rings true today as all carriers have multiple perils in their state. In 2023, we saw 24 disasters—CAT-events and micro-CATs— costing an estimated $67 billion. Have certain regions become more vulnerable to these events, and do they pose a long-term concern?

RJ: For as long as I have been in the industry, there has certainly been a shift in the weather patterns. More prevalent, high-intensity storms are striking the Midwest with unprecedented frequency. Earlier in 2023, Vermont had torrential rains and floods for the first time in 150 years. This extreme weather signals a new paradigm for insurers, questioning where we can comfortably write business and without expecting large storm activity.

GH: Absolutely, and the addition of a measured response is critical. Over the past few years, the 12 states I referenced have been impacted more than any other states combined, save Florida. Additionally, that short period experienced a significant impact during an extended La Niña phase, characterized by a convergence of the polar and Pacific jet streams. This phenomenon has led to increased weather volatility, especially evident in the unique Y-shaped storm affecting New England and the southeast earlier this year. Understanding the science behind these patterns is vital, as it offers a degree of predictability.

DT: La Niña's influence on wildfires, particularly in Mauia, has shown the importance of analyzing data to forecast losses. Nationwide, with its extensive focus on climate, must have robust processes for such assessments. Zac, how does this influence your daily risk management strategies?

ZC: It shows the reality climate change is reshaping our landscape. For example, Tornado Alley, historically in the Texas-Oklahoma area, has migrated eastward. This wider spread of Tornado Alley has even placed Nashville within a broader danger zone for tornadoes and other severe weather. We must stay vigilant, continuously monitoring weather patterns to understand the full scope of these shifts, highlighted by the perfect example of the multi-billion-dollar disasters.

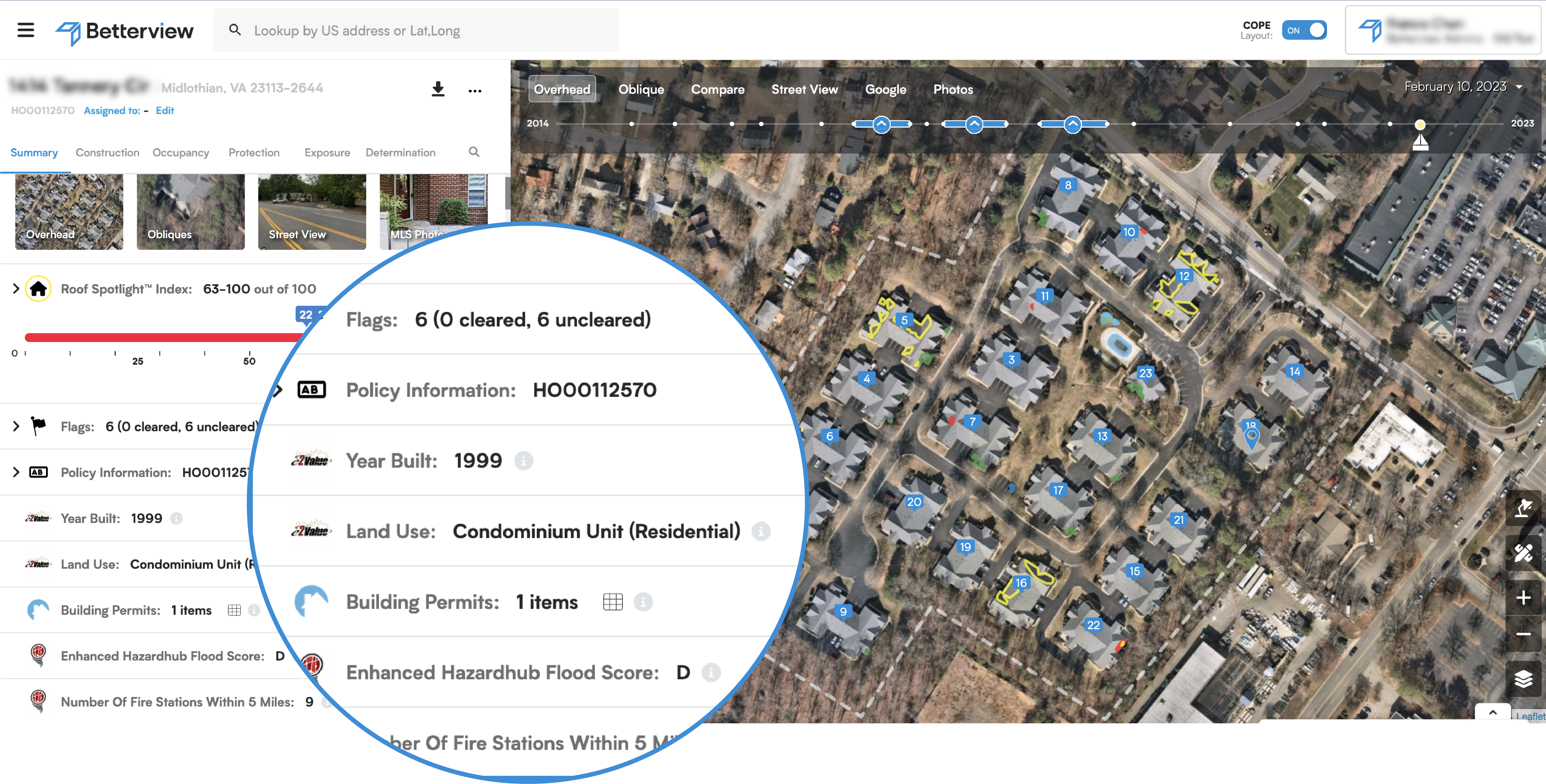

To learn how Betteview by Nearmap can help you mitigate risk and predict and prevent losses, reach out here.

How can insurers rate more effectively when property condition across the US is changing more frequently than ever? This is a significant challenge ...

The property & casualty insurance industry is undergoing a seismic shift. Many factors, including an increase in severe weather events and changing...

Modern P&C insurance companies face a number of complex and evolving challenges. These include changing expectations from policyholders, along with...