How can Property Intelligence Help You Manage Risk?

Why do P&C insurance companies need property intelligence? That is what this series of blog posts has attempted to answer. First, we discussed how...

The property & casualty insurance industry is undergoing a seismic shift. Many factors, including an increase in severe weather events and changing expectations from customers, have forced insurance companies to reconsider traditional ways of doing business. In order to remain profitable and continue to provide protection to homeowners, businesses, and communities, insurers are seeking out new tools and strategies. Some of these companies have begun to utilize a vast array of geospatial datasets and insights – many of them powered by artificial intelligence (AI) and computer vision – that are collectively referred to as property intelligence.

Property intelligence resists one single definition, serving as more of an umbrella term for a diverse collection of tools, solutions, and datasets. Broadly speaking, property intelligence refers to anything that can tell you more about a property than the naked eye. This means property intelligence could be a historical record of hurricanes in a property’s ZIP code. Or, it could be a database of permits filed for a specific property. There is nothing mystical about property intelligence: in its most basic form, it consists of any and all information relevant to determining a property’s level of risk.

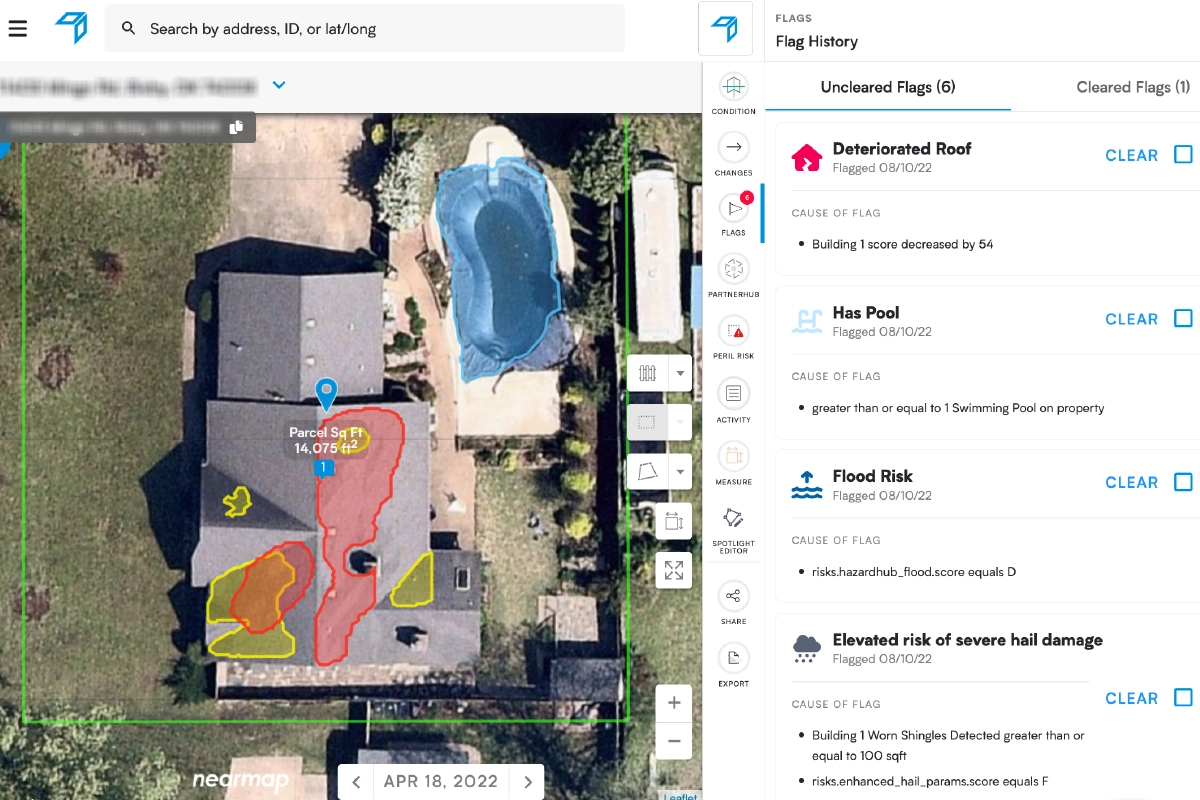

One of the most powerful forms of property intelligence involves using AI models to analyze geospatial imagery. By using computer vision to analyze high-quality imagery, a property intelligence platform can spotlight specific risk drivers down to individual missing shingles on a roof. This data can be used to create an overall risk score for a property or even to determine how vulnerable it is to specific perils. As a result, underwriters are empowered to make faster, smarter decisions based on a better understanding of overall risk.

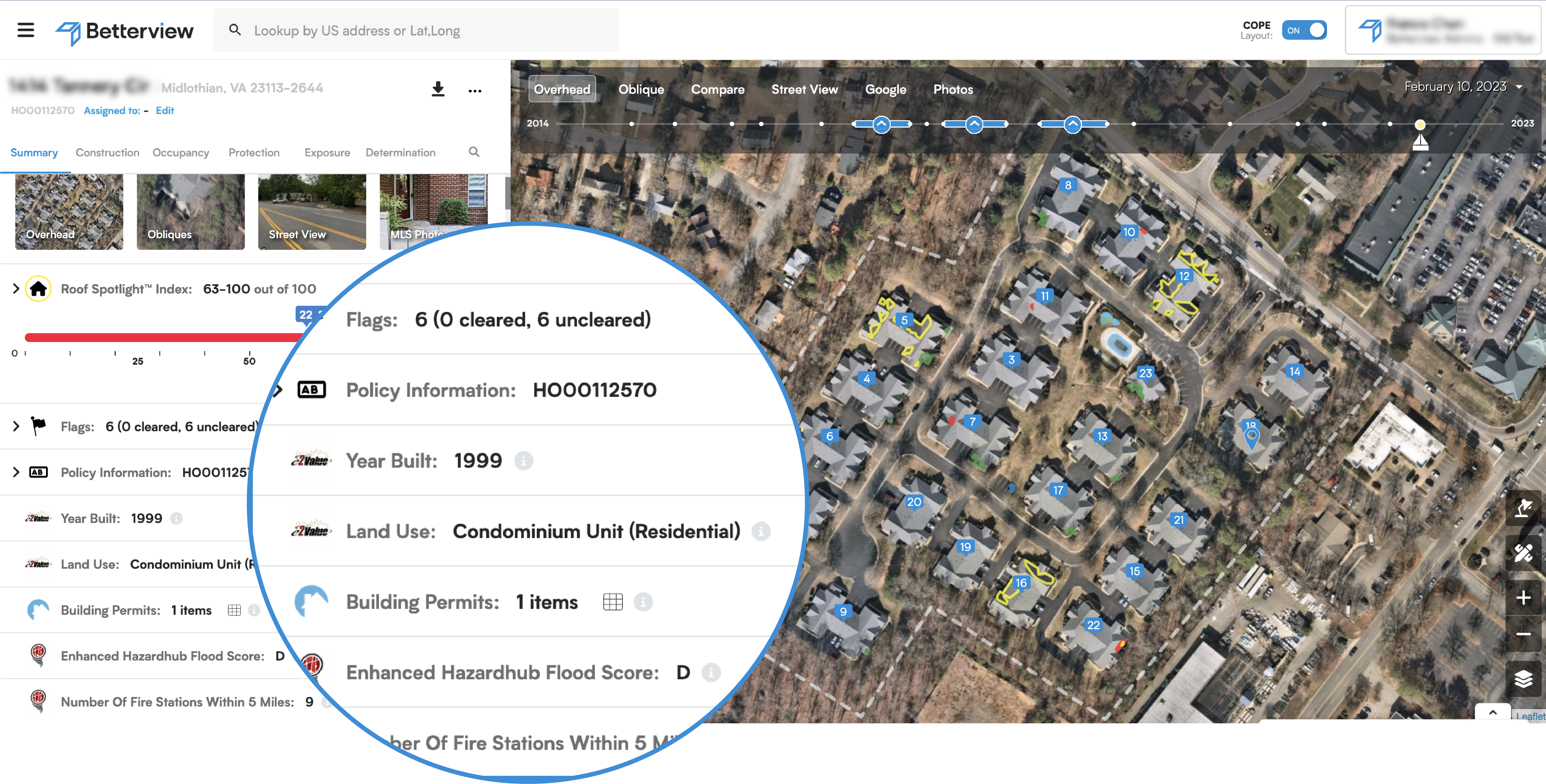

An example of the Betterview property intelligence platform

The vast breadth of property intelligence should not be underestimated; the sheer amount of data can be overwhelming to many insurance professionals. If it is not properly introduced, property intelligence may slow down the very processes it was designed to expedite. That is why property intelligence works best when it is contained in an easy-to-use platform, designed to seamlessly integrate with existing workflows.

Property intelligence can be used to boost efficiency and predict and prevent losses at every step of the policy lifecycle.

Quoting: Thanks to disrupters in the space, many customers have become accustomed to a lightning-fast quoting process. Pre-filled information on a property’s condition and risk level (AKA property intelligence) can assure that these quotes are as accurate as they are fast.

Underwriting/Inspections: The inspection process is vital to determine a property’s condition and properly price risk. However, physical inspections can prove costly, inefficient, and inaccurate. A property intelligence platform uses geospatial imagery to preemptively determine which properties are a solid risk that can be automated, and which ones need a physical inspection (see our Automation & Flagging Blog).

Claims: To speed up the often-turbulent claims process, and to ward off fraudulent claims, property intelligence can be an insurer’s best friend. Rapid imagery from providers like EagleView and the Geospatial Insurance Consortium (GIC) can show property condition long before a physical inspection team can visit the site, jumpstarting the claims process before the first notice of loss (FNOL). Historical imagery can also show condition before and after a claim, revealing which damage in the claim is legitimate and which preceded the event in question (see our CAT Response System).

Renewal: Properties change over time, but insurers are not always able to maintain an accurate view of property condition using inspections alone. Many insurers may have not set eyes on a property for years when it is up for renewal. Regularly -collected geospatial imagery can solve this problem for insurers at renewal time, especially when computer vision is used to show what has changed over time (see our Customized Automation Tools Blog).

Loss Control: The true power of property intelligence is not just its ability to show current condition and risk, but to project into the future. Using a combination of computer vision detections and third-party hazard data, a property intelligence platform can proactively inform insurers and policyholders how they can mitigate risk on a property. This could be as simple as repairing a roof or trimming some trees, but it may help prevent a loss, lower premiums, and help policyholders feel a little safer.

These are just a few examples of how property intelligence can be used to drive down expenses, predict and prevent losses, and improve the customer experience. In the coming weeks, we will go into more depth on how a property intelligence platform can analyze, score, manage, and monitor risk.

Why do P&C insurance companies need property intelligence? That is what this series of blog posts has attempted to answer. First, we discussed how...

In our last blog post, we posed a significant question: what is property intelligence? Though the term carries many meanings, it can be generally...

A few weeks ago, I wrote a piece exploring how the P&C insurance industry might fare during a potential inflationary recession. While conceding the...