What is Property Intelligence?

The property & casualty insurance industry is undergoing a seismic shift. Many factors, including an increase in severe weather events and changing...

3 min read

Bob Klepper

:

Aug 30, 2022 8:00:00 AM

Bob Klepper

:

Aug 30, 2022 8:00:00 AM

A few weeks ago, I wrote a piece exploring how the P&C insurance industry might fare during a potential inflationary recession. While conceding the ways in which the industry may be typically “immune” from the worst impacts of economic downturn, I also cautioned against complacency. Facing adverse economic conditions, insurance companies need to consider evolving their risk management approach to enhance the ability to remain profitable and competitive. Today, I would like to discuss what this “evolved approach” looks like, and specifically the strategic advantages of adopting a property intelligence system like the Betterview platform.

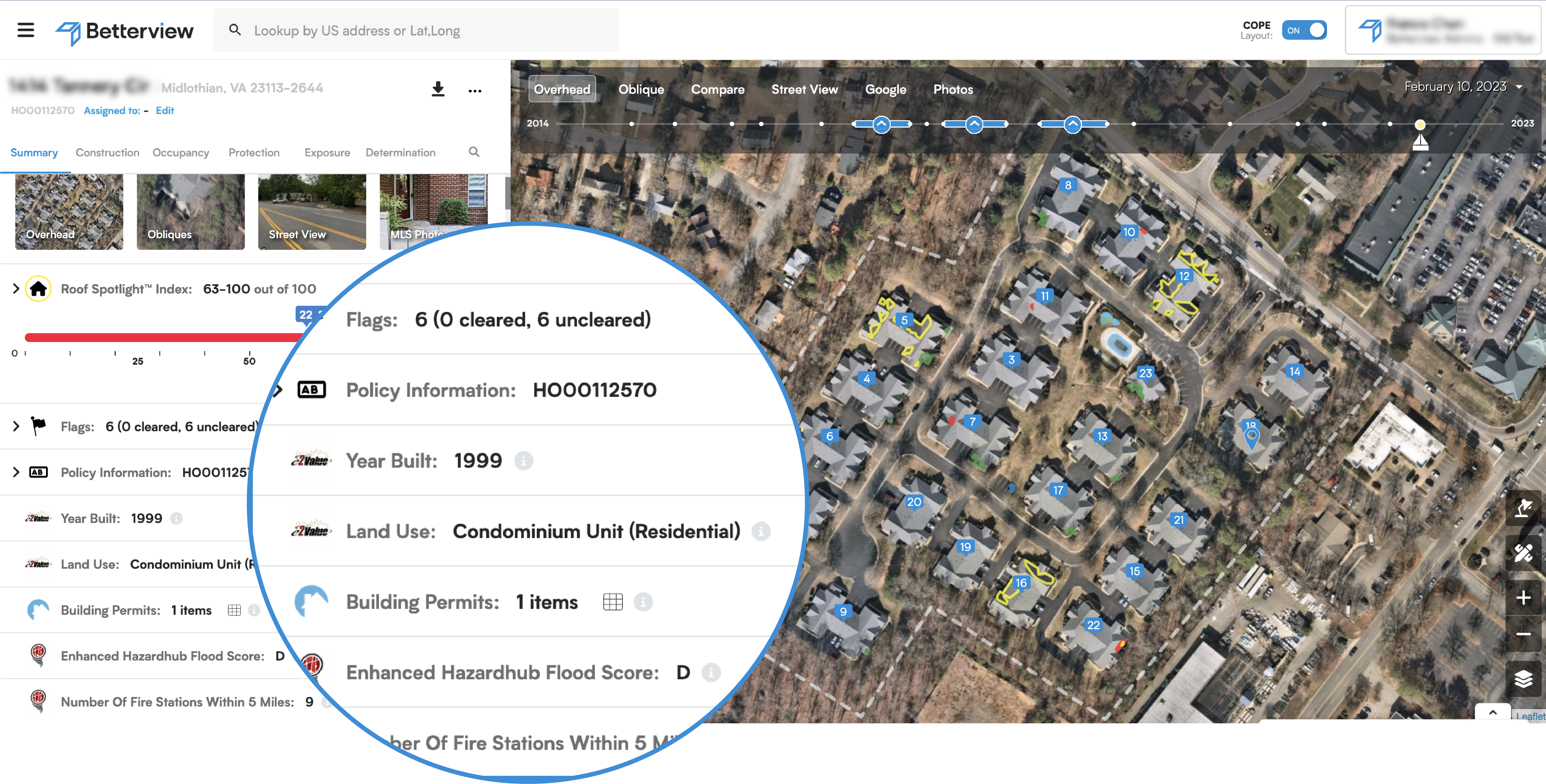

Property intelligence refers to a diverse array of datasets, computer vision detections, and other resources that empower insurers to analyze, score, manage, and monitor real property risk. The goal is not to proliferate as much data as possible, but to synthesize relevant and complementary datasets into a form that can affect immediate, strategic action. This means that property intelligence must be easy to use and to understand. Data must be structured in a way that does not undermine, but enhances existing underwriting workflows. Properly integrated, property intelligence does not replace the necessary element that individual underwriter’s contribution to risk selection. Instead, it allows underwriters to make faster, smarter, and more informed decisions at every stage of the policy lifecycle.

By improving accuracy and efficiency, property intelligence can help insurers to improve combined ratios, even during recessionary cycle challenges. What follows are a few examples of use cases for the application of property intelligence.

In order to properly identify, select and price risk, underwriters need a timely, comprehensive view of current property conditions. Obtaining essential location attribute data is essential to proper risk selection assessments, especially at the pre-qualification level. Critical COPE information and other quantitative and qualitative features are imperative to make underwriting decisions. This data is required for assessing asset valuation, building features (including secondary modifiers) associated with natural catastrophe and fire PMLs (Probably Maximum Loss), as well as measuring ultimate risk appetite necessary for underwriting referrals, and structuring facultative and portfolio level treaty reinsurance. Efficiently collecting this data via aerial imaging, enhanced by AI, can be a more accurate and cost-effective means to qualify underwriting risks versus onsite inspections.

In recent years, thanks to innovations from companies like Lemonade and Hippo, customers have come to expect immediate quotes from insurers. Historically, rapid quotes meant a trade-off on accuracy, leading to premium leakage over time. With property intelligence from a company like Betterview, insurers no longer have to compromise between speed and accuracy. Instead, companies can return quotes at sub-minute speeds while ensuring risks are properly priced. The result is a healthier combined ratio, alongside an improved customer experience.

Loss prevention surveys are important and allow for a productive collaboration between insurers and their policyholders. These site surveys provide their policyholders robust risk evaluation and associated loss control recommendations. Traditionally, site surveys were provided by physical inspection teams. However, there can be drawbacks to this approach. First, many locations would not qualify for a site survey due to protocols related to location value thresholds and other inefficiencies. Also, timing to conduct and publish a survey can take 30-90 days or more. In contrast, a property intelligence platform can provide many of the required location level risk attributes in less than 4 seconds.

In addition to driving efficiency, property intelligence can also improve the quality of the inspection process. It is estimated that 40% of property claims paid are related to poor roof conditions. Although some maladies associated with roof conditions can be identified through onsite roof inspections, overall roof assessments can be a challenge based on several factors including access, safety and scale at which the observations are made. Aerial imagery and computer vision tools on the other hand, can determine with reasonable accuracy many attributes that drive losses including missing shingles, ponding, staining, etc.

Property intelligence can help insurers respond rapidly to claims, effectively distribute budget and resources, and prevent fraudulent claims from going undetected. A key advantage that property intelligence brings to claims is high-quality, near-real-time imagery. Although there are multiple ways to collect this imagery, many experts in the field (such as Jason Janofsky, CTO at Betterview) believe that aerial imagery is the best option. This imagery can show insurers external property conditions before, during, and after a catastrophic event, allowing them to jump-start the claims process prior to First Notice of Loss (FNOL). In addition, by utilizing available historical imagery, insurers can also detect whether damage preexisted an event – which is valuable in determining actual claim values and establishing future loss prevention measures

One of the breakthroughs of property intelligence is the ability to show conditions at a specific property over time, providing a more complete historical context. Properties can change significantly over time, and based on survey frequency protocols, Insurers reliant on manual inspections may go several years between survey visits. With access to geospatial imagery and computer vision detections, however, insurers may now stay current with site-level property conditions. Underwriters can see, for example, whether a secondary structure has been added to a parcel or if new hazards are now present on or adjoining the site. They can also observe and evaluate if certain critical maintenance procedures are being provided by their insureds, especially during economic downturns where budget constraints may exist. The ability to monitor changing property conditions using historical imagery provides better context to properly select, price and set appropriate policy terms and conditions.

Ultimately, strategically leveraging property intelligence is one of the best ways that property insurers can maintain profitability, especially during an economic downturn. For the use cases I have listed and more, property intelligence can be crucial for improving efficiency, driving down avoidable losses, and building a stronger customer experience.

The property & casualty insurance industry is undergoing a seismic shift. Many factors, including an increase in severe weather events and changing...

In our last blog post, we posed a significant question: what is property intelligence? Though the term carries many meanings, it can be generally...

To manage risk and build resilience, P&C insurers need accurate property imagery. It'sa crucial componentof aneffective property intelligence toolkit...