Protect Customers with Hail Risk Insights

Insurers need tools to mitigate hail risk, one of the costliest and most common sources of claims. The solution is Betterview’s Hail Risk Insights,...

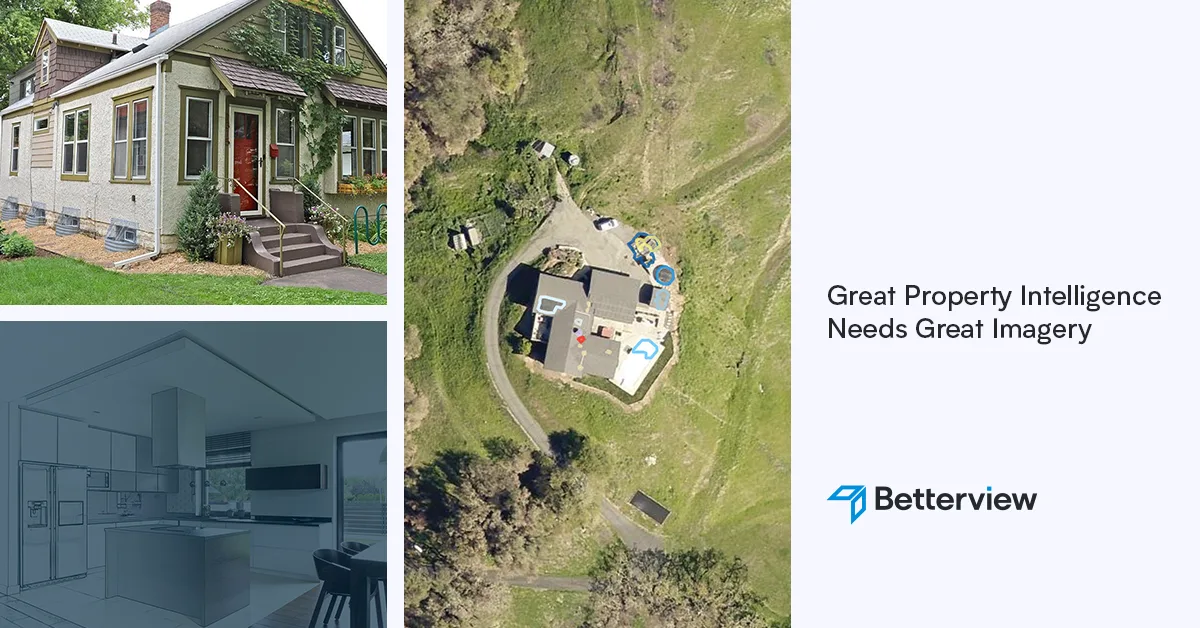

To manage risk and build resilience, P&C insurers need accurate property imagery. It's a crucial component of an effective property intelligence toolkit. When paired with artificial intelligence (AI), imagery can reveal insights about property down to a damaged shingle on a roof. That’s why, since our founding, Betterview has enhanced our Property Intelligence Platform with a vast selection of high-quality imagery from numerous trusted partners. Explore how to leverage this imagery selection to accelerate quoting and underwriting, reduce expenses, and mitigate losses.

Multiple Imagery Sources

Great imagery is the foundation of our Property Intelligence and Risk Management platform. Generally, we have found aerial imagery to be the most reliable source. But many use cases call for other methodologies too. Recognizing that insurers have unique needs, we offer a wide variety of imagery sources from our trusted partners:

Unlocking Insights with Artificial Intelligence

We gathered an elite group of partners to stock our platform with high-quality imagery from multiple sources. Next, we applied our computer vision and machine learning models to transform images into insights – which platform users then turn into immediate policy actions.

Computer Vision for Underwriting & Quoting: Our computer vision models analyze images and spotlight the presence of over 40 condition attributes for optimal underwriting and quoting efficiency. Underwriters can flag and instantly view properties with relevant attributes like aging roofs or insufficient defensible space. They can straight-through-process low-risk properties, allocate resources to higher-risk properties, and unlock countless more efficiencies. That’s not to mention our predictive scores, which reliably determine vulnerability to specific perils (many of which are pre-filed for faster quoting). Our computer vision models plus imagery from our partners is a winning formula for efficiently managing risk and avoiding losses.

Historical View for Renewals & Claims: Our multi-decade archive of historical imagery automatically detects property condition changes over time, generating a number of relevant insights. It also makes it easy to compare historical and current images, either side-by-side or in a timeline view. During renewal, an underwriter may notice a swimming pool that wasn’t there the last time they checked and adjust the policy accordingly. Following a claim, they can quickly verify damage that preexisted the loss event to avoid fraud. The addition of historical context overall makes for a better, richer view of property condition and even empowers our industry-leading, highly accurate estimation of roof age.

Post-Event Imagery for Catastrophic Response: After a catastrophic or severe weather event, insurers need to respond fast and accurately. Instead of waiting for inspection teams to arrive at the property – which is often impeded by on-the-ground conditions – our CAT Response System provides rapid access to post-event imagery. We analyze this imagery with computer vision detections and identify property damages to empower claims teams to prioritize resources, more accurately predict losses, and expedite the claims process even before first notice of loss (FNOL).

Accurate assessment of risk for rapid quoting, underwriting, and loss avoidance

Seamless renewals with automatic change detections

Accelerated response following claims and catastrophic events

Better serve your customers, predict and prevent losses, and make more confident decisions with the AI-powered imagery on the Betterview platform. Whether it’s faster quoting, improved claims response, or a more accurate assessment of overall risk, imagery is what you need – and our platform is the best place to get it.

Insurers need tools to mitigate hail risk, one of the costliest and most common sources of claims. The solution is Betterview’s Hail Risk Insights,...

How can we make life easier for underwriters? That question informs everything we do at Betterview. Not just because faster underwriting means lower...

The insurance industry, and the technology that supports it, have seen significant change over the last few years. New technology continues to come...