Formulate a Stronger Hail Strategy with Betterview

Betterview is pleased to announce the addition of Hail Risk Insights to our platform. Using these insights, our platform is able to analyze and...

Insurers need tools to mitigate hail risk, one of the costliest and most common sources of claims. The solution is Betterview’s Hail Risk Insights, which combines our structural vulnerability detections with hazard data from trusted third parties—this is done via our Partner Connect program to provide insurers with insights to predict and prevent hail losses. Hail Risk Insights empowers insurers to improve risk selection and rate segmentation, refine underwriting in hail zones, and better protect customers.

Pinpoint Property Vulnerabilities with Computer Vision

The first piece of determining hail risk is what Betterview does best: structural vulnerability. This refers to the specific attributes of a property that increase its susceptibility to hail damage. To pinpoint these attributes, we apply computer vision models to high-quality property imagery and spotlight relevant risk factors.

From there, we analyze historical claims datasets to determine which of these attributes – including building footprint, roof material, roof condition, and roof staining – are most correlated with hail damage. These attributes are synthesized into the numerical Hail Vulnerability Score, allowing users to assess a property's hail vulnerability in a single glance.

Merging Insights: Betterview and Partner Data

Next, we transform vulnerability insights into a comprehensive view of total hail risk. The key is to enhance vulnerability with hazard, or the likelihood that a property will experience a hail event based on regional factors. To determine hail hazard, we integrate datasets from trusted partners directly into our platform as part of our partner program, Partner Connect.

To recap: by accessing hazard data through Partner Connect, insurers confidently estimate where a hail event will strike relative to a specific property. Then, with our vulnerability detections, they determine how much damage that property will experience. But how do we make these insights even more powerful? The answer is by combining them into a single, reliable indicator of total hail risk: the Hail Claim Predictor.

Leverage the Hail Claim Predictor

We combined HazardHub’s Enhanced Hail Score or the FEMA’s Hail Hazard Risk Index Score with our own Hail Vulnerability Score to create a single, highly predictive tool: the Hail Claim Predictor. Equipped with the Predictor, you can transition from reactively managing risk to proactively strengthening resilience. The example below demonstrates how property-level vulnerability significantly influences overall hail claim risk. This risk varies, even for properties located in the same area.

Let’s see how the Hail Claim Predictor creates value throughout the policy lifecycle.

With a blend of rich data and artificial intelligence, Hail Risk Insights gives you the tools you need to protect your customers from hail damage, expand profitability in hail-prone regions, and streamline underwriting efficiency. Explore Hail Risk Insights today, including the Hail Claim Predictor and hail data from industry-trusted partners, and take control over hail claim risks.

Betterview is pleased to announce the addition of Hail Risk Insights to our platform. Using these insights, our platform is able to analyze and...

Betterview’s Wildfire Risk Insights empower P&C insurers like you to predict and prevent wildfire damage. These insights combine computer vision...

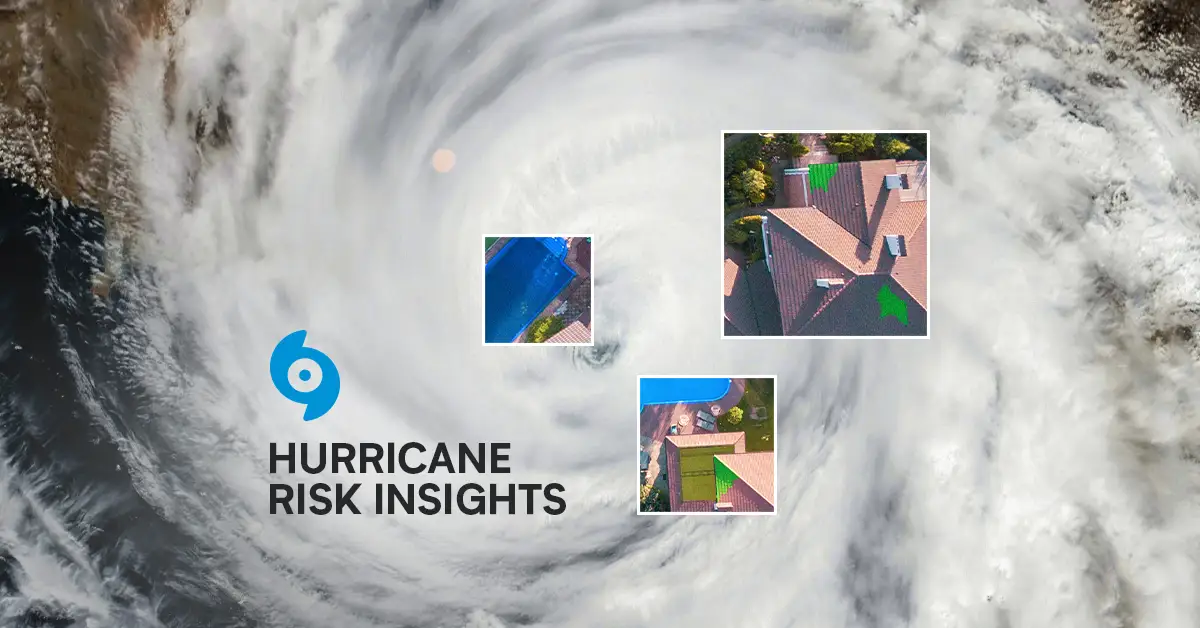

Insurers need comprehensive hurricane insights to protect customers and build resilience amidst increasing storm severity. Betterview has the answer:...