Predict and Prevent Losses with Betterview’s Wildfire Risk Insights

Betterview’s Wildfire Risk Insights empower P&C insurers like you to predict and prevent wildfire damage. These insights combine computer vision...

Modern P&C insurance companies face a number of complex and evolving challenges. These include changing expectations from policyholders, along with disruptions to the industry from new entrants in the space. But perhaps the greatest challenge facing P&C insurers today is that the nature of risk has become increasingly unpredictable. The impact of climate change on our weather system is undeniable and can be seen in worsening hurricane and wildfire seasons across the United States. Insurers in these states face a difficult choice: do they continue to write policies in high-risk areas, knowing they will sacrifice profitability? Or – as several insurers have begun to do in Florida and California – do they raise premiums and cancel policies en-masse, eroding trust in the insurance industry and leaving policyholders without protection?

Neither of these strategies is viable in the long term because neither answers the fundamental problem facing insurers. Namely, how can insurers evolve their approach to risk? The idea of risk underlies every aspect of P&C insurance. Risk must be defined, it must be evaluated for every property, and it must be managed to predict and prevent future losses. If insurers do not have the proper tools to identify and manage real property risk, then they are wasting time and resources only to make uninformed decisions. In order to reduce losses, streamline efficiency, and improve relationships with the insured, insurers need to adopt a new approach to risk management.

Betterview takes this subject quite seriously. Providing insurers with a complete, holistic, and actionable view of real property risk is the central goal of our platform. This begins, of course, with forming a consistent definition of risk. This definition for our company exists as a simple equation: Hazard * Vulnerability = Risk. The different variables in this equation are informed by different features on our platform. What follows is a brief explanation of these terms and a demonstration of where they can be found on our platform.

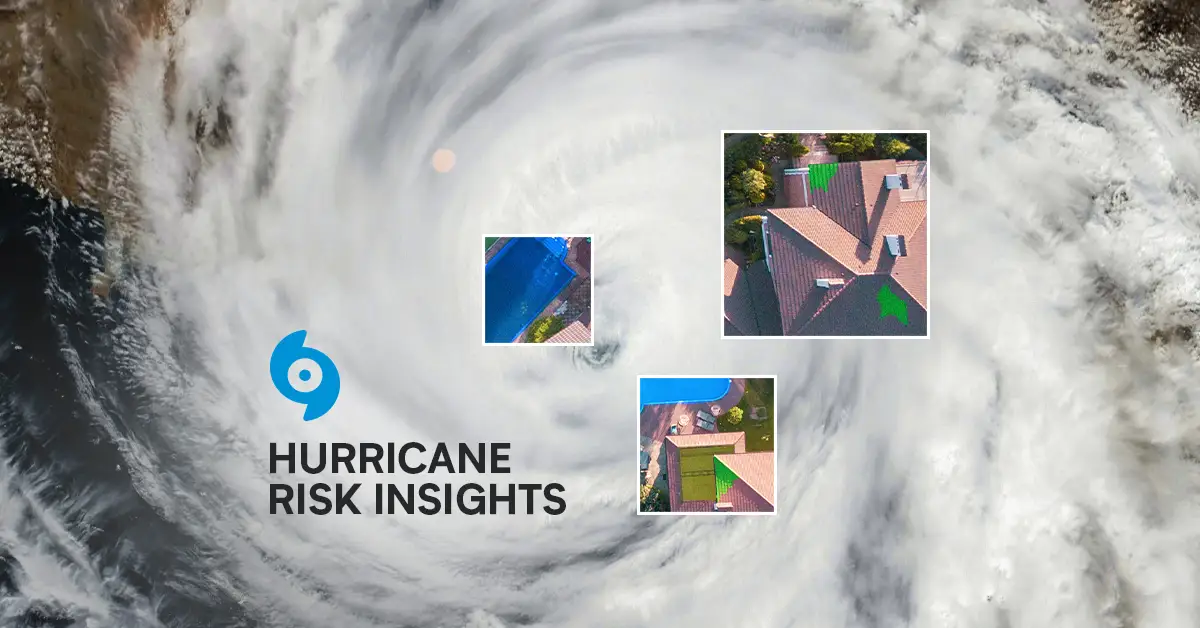

Hazard refers to the likelihood and level of impact that a region will experience in a specific catastrophic event. Properties in certain dryer parts of the Western United States, for example, may have a high hazard exposure to wildfires. Properties in coastal states such as Florida, on the other hand, are less exposed to wildfire but at a higher hazard of hurricane damage. The Betterview platform provides hazard information by integrating third-party data from trusted companies like RedZone, HazardHub, Canopy Weather, Federal Emergency Management Agency (FEMA), and more via PartnerHub, our third-party property intelligence marketplace.

Vulnerability refers to the amount of damage a property is likely to experience in the event a disaster does strike. Hazard can be thought of as the big picture, whereas vulnerability zooms into the individual property level. Vulnerability takes into account myriad factors relating to property condition, maintenance, and more. The Betterview platform uses aerial imagery and computer vision detections to create a complete picture of property-level vulnerability. Property attributes that are factored into our vulnerability detections include elements in our 100-point roof score, our defensible space detections, and more. These detections allow us to provide easy-to-understand numerical vulnerability scores for multiple perils including hurricane and wildfire.

By considering both factors, Betterview lands once again on the simple formula: Hazard * Vulnerability = Risk. Our Wildfire and Hurricane Risk Insights solutions leverage a combination of third-party hazard data and native vulnerability insights to give a complete view of risk for every property in an insurer’s book. This differentiates us from other products on the market, which often look solely at hazard data, not considering property-specific attributes. For a complete view of risk, empowering underwriters to take immediate and strategic policy actions, look to Betterview.

Betterview’s Wildfire Risk Insights empower P&C insurers like you to predict and prevent wildfire damage. These insights combine computer vision...

In an article written in collaboration with the Insurance Thought Leadership, “How to Cruise Through the New Florida Property Insurance Legislation”,...

Insurers need comprehensive hurricane insights to protect customers and build resilience amidst increasing storm severity. Betterview has the answer:...