Building Resilience with Betterview’s Hurricane Risk Insights

Insurers need comprehensive hurricane insights to protect customers and build resilience amidst increasing storm severity. Betterview has the answer:...

3 min read

Meadow Green

:

Aug 22, 2022 8:00:00 AM

Meadow Green

:

Aug 22, 2022 8:00:00 AM

In an article written in collaboration with the Insurance Thought Leadership, “How to Cruise Through the New Florida Property Insurance Legislation”, Betterview co-founder and COO Dave Tobias discusses the new legislation recently passed by the Florida state government. The new law confronts challenges facing property insurers and homeowners in Florida as we are seeing worsening hurricane seasons. Read the article here to learn more about the law, its connection to increasing hurricane risk, and its implications for homeowners and insurers.

Here, we’d like to talk about how the Betterview Property Intelligence and Risk Management platform can specifically help insurers in Florida manage risk while complying with the new legislation.

Components of the new Florida Legislation:

The new legislation – similar to the recent “Safer From Wildfire” framework in California – recognizes that hurricanes are increasing in frequency and severity, adversely affecting insurers and policyholders in coastal states. Existing tools are often insufficient to give insurers a complete view of real hurricane risk. As a result, insurers are forced to write policies blind, increasing the likelihood of paying out major claims. Otherwise, they must raise premiums dramatically or even cancel policies en-masse. Both of these options are unsustainable. Insurers need new tools to give them a comprehensive, actionable view of hurricane risk.

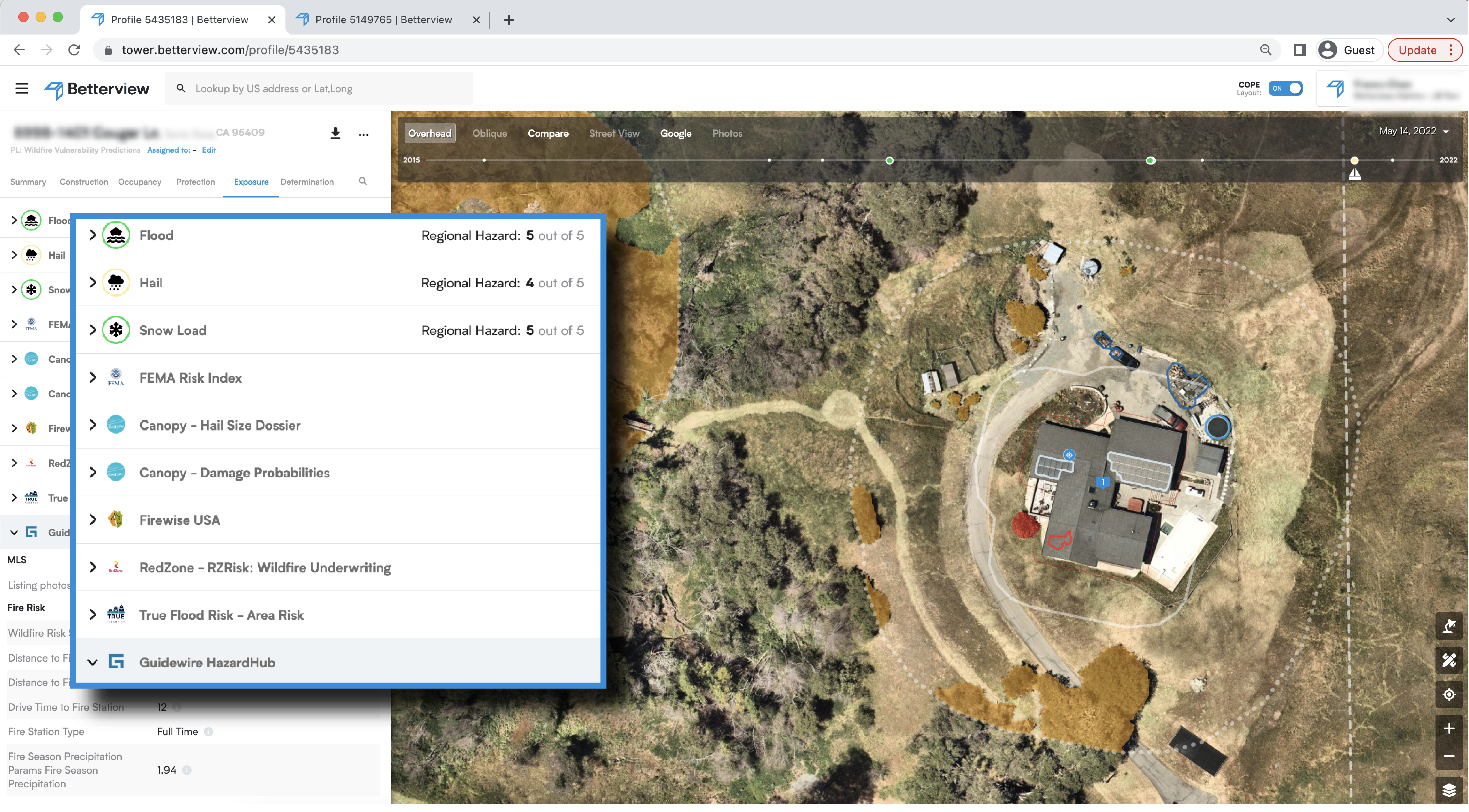

This is where the Betterview Property Intelligence and Risk Management Platform comes in. Our platform uses a combination of high-quality aerial imagery, computer vision detections, and third-party data to help insurers identify and manage real property risk. This combination of technologies, and the easy-to-use nature of our platform, is precisely what you need to mitigate risk, especially hurricane risk in coastal states like Florida. There are many features on our platform that are especially relevant to the situation in Florida:

P&C insurers are in the business of providing peace-of-mind to their insured. In the face of increasing hurricane risk, this task has been made more difficult. Insurers must evolve to changing conditions, and to do so they need new tools and technologies. With the help of the Betterview Property Intelligence and Risk Management platform, and informed by new legislation, insurers can better protect homeowners, businesses, and communities from the effects of hurricane damage.

If you want to learn how the solutions on the Betterview platform can empower insurers to predict and prevent losses – including our new Hurricane Risk Insights – head to our site to learn more, and contact us today.

Insurers need comprehensive hurricane insights to protect customers and build resilience amidst increasing storm severity. Betterview has the answer:...

The right peril data makes a tremendous difference for P&C insurers – especially as states like Florida and California introduce new regulations...

Modern P&C insurance companies face a number of complex and evolving challenges. These include changing expectations from policyholders, along with...