Building Resilience with Betterview’s Hurricane Risk Insights

Insurers need comprehensive hurricane insights to protect customers and build resilience amidst increasing storm severity. Betterview has the answer:...

The right peril data makes a tremendous difference for P&C insurers – especially as states like Florida and California introduce new regulations around evolving climatic risks. That’s why Betterview has assembled the most accurate selection of third-party hazard data (available through our partner program, Partner Connect, alongside inspection tools, business data, and other sources of geospatial data) and combined it with our own property-level vulnerability data for a complete view of peril risk. This unique combination empowers insurers to make immediate, critical decisions to protect policyholders and reduce losses.

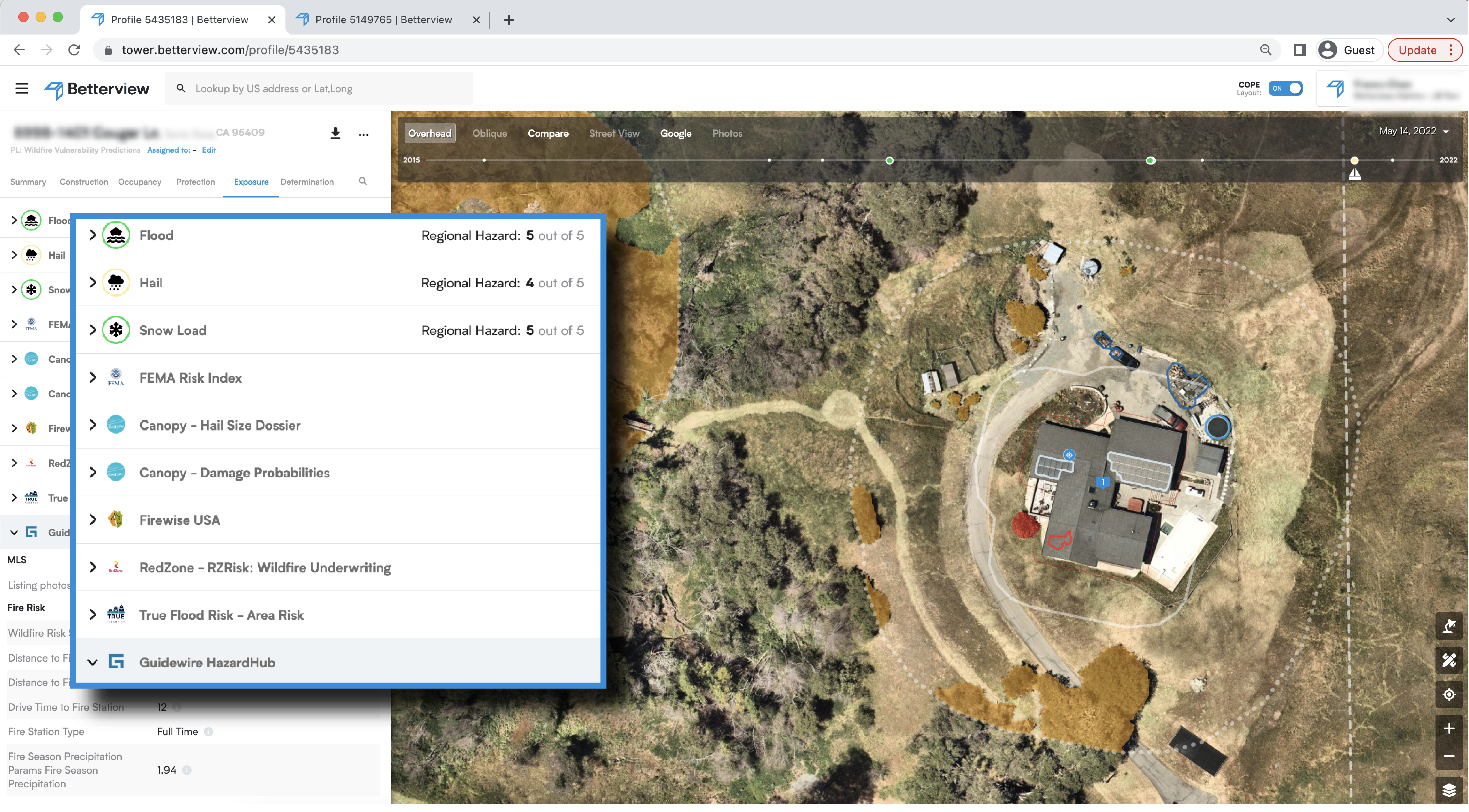

Peril Data in the Betterview Platform

Sourced from the most innovative and trusted companies in the industry and enhanced with AI-powered vulnerability insights, our peril data is all insurers need to identify exposures, anticipate damage, and protect customers.

A Complete Picture of Risk

P&C Insurers have long had access to regional hazard data and CAT models, but this alone does not provide a complete picture of peril risk. The crucial missing factor is vulnerability – the likelihood that a specific structure will experience damage based on property condition. Our machine learning models are built to reveal property vulnerability, identifying factors like missing shingles, roof stains, roof material, and defensible space. These factors are turned into vulnerability scores for specific perils and combined with third-party regional hazard data to reveal overall risk:

(Peril data partners through Betterview Partner Connect)

These combined comprehensive insights not only help you identify exposures and reduce losses, but also empower you to be an insurance hero to your customers. If a property has insufficient defensible space and is in a historically wildfire-prone area (high wildfire hazard score), you might decide to raise premiums or recommend the policyholder trim vegetation overgrowth. A property located in the same area but with sufficient defensible space and no yard debris, on the other hand, is considered lower risk and you might offer premium discount instead of declining coverage.

These savings and efficiencies, beneficial for both insurer and insured, are possible with our trusted peril data partners, available on the Betterview platform via Partner Connect.

Insurers need comprehensive hurricane insights to protect customers and build resilience amidst increasing storm severity. Betterview has the answer:...

Betterview’s Wildfire Risk Insights empower P&C insurers like you to predict and prevent wildfire damage. These insights combine computer vision...

Insurers need more than mass amounts of data to accurately and efficiently assess risk. The data must be functional: organized intuitively, enhanced...