From Imagery to Insights to Answers

What does the Nearmap acquisition of Betterview mean for the insurance industry?

How can insurers rate more effectively when property condition across the US is changing more frequently than ever? This is a significant challenge for insurers, made more complicated by climate risk, economic instability, reinsurance trends, and rising replacement costs. To navigate this complex environment, insurers need adaptive strategies—enhanced by cutting-edge technology—to accurately evaluate risk in 2024.

Historical Cycles and Current Pressures

Our current market faces challenges with setting accurate insurance rates and dealing with frequent policy cancellations. The cover image below from Time magazine may resonate with many insurers. It spends considerable time on the Florida and California markets and other problem areas across the United States.

It may be difficult to immediately notice, but the fine print above the letter “T” shows this article was from March of 1986. So, what has changed if anything? This piece from the past underscores an important message for today's market: we have been through a hard market before, just like we are in today. Although, it’s recognized that the current market is much harder. This perspective is not meant to dismiss the pressures of the present. Rather, it reminds us that market pressures are cyclical, and preparation is key to surviving these cycles.

Adapting Rating Strategies

Insurers are not just looking for effective rates—they are seeking accurate risk valuation. When writing new business, it’s critical to ensure the best possible risks are insured, while eliminating potential surprises at renewal. To do this, insurers need the right tools in hand that enable them to accurately evaluate property risk.

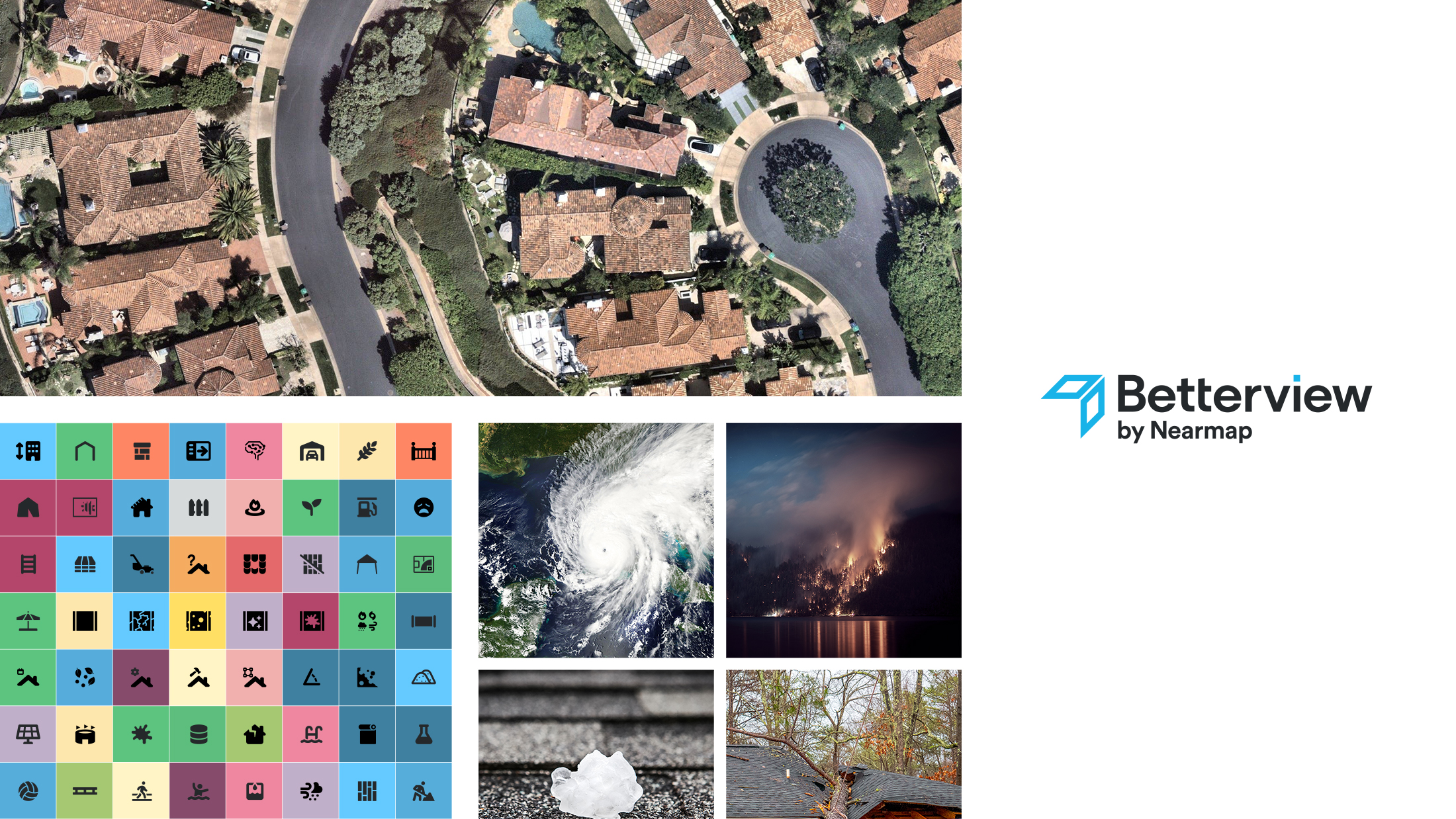

Coming from the insurance industry myself, I witnessed firsthand the difficulties insurers face in obtaining a clear view of the properties in their book. That’s why we built our Property Intelligence Platform specifically tailored to insurance workflows. Marked by state-of-the-art imagery, Artificial Intelligence (AI), and computer vision, we can transform the methods insurers use to evaluate and rate risk:

With these tools in hand, insurers elevate beyond traditional approaches, providing detailed, property-specific insights that facilitate tailored risk management strategies based on their unique needs.

Staying Agile in a Modern Market

How can insurers maintain agility in the current, hard market? Reinsurance is one key component of the rating puzzle. Insurers of all sizes—large, medium, or small—are rethinking their reinsurance strategies in response to rising premiums. In addition, insurers are facing the challenge of increased retentions, choosing to increase their self-insurance thresholds and take on more risk before reinsurance takes effect. It’s become standard for these companies to invest in different levels of their catastrophe protection plans. This trend has left insurers with higher upfront costs, reduced financial reserves, and a larger share of potential losses that can impact their financial stability.

There are a few primary strategies to address these challenges: insurers can adjust pricing to better reflect the risk, or they can transfer risk using methods such as reinsurance or a combination of approaches. Here, innovative methods are vital. Technologies like the Betterview platform provide detailed insights of property condition and enable insurers to tailor their strategies to their specific needs. Adaptability is crucial to ensure accurate risk pricing, particularly in commercial and underwriting activities. If insurers can prepare their underwriters with the data and confidence they need, they are more likely to achieve the necessary rate.

A Call for Continued Innovation

The need for innovation in rating is clear. The Betterview platform by Nearmap provides a comprehensive toolkit—from imagery capture to processing, and analyzing imagery for detailed property insights, insurers get the risk assessments they need to reduce losses and increase efficiency. As insurers face new business and renewals, integrating these data sources and technology will be pivotal. The journey ahead will not just be about surviving P&C insurance cycles but thriving through them.

What does the Nearmap acquisition of Betterview mean for the insurance industry?

When Betterview launched the Roof Agesolution in April 2023—the first of its kind—it sparked a new wave of insurtech product innovation and risk...

The insurance industry, and the technology that supports it, have seen significant change over the last few years. New technology continues to come...