Betterview, which is quickly becoming the platform essential to every transaction around buildings and properties, and Nationwide today announced a three-year commercial agreement enabling the insurance carrier to utilize Betterview’s predictive roof analytics and risk management platform for commercial property renewals. The partnership demonstrates a deepened relationship between Betterview and Nationwide, after the insurer made its initial investment in the artificial intelligence-powered startup in May 2018.

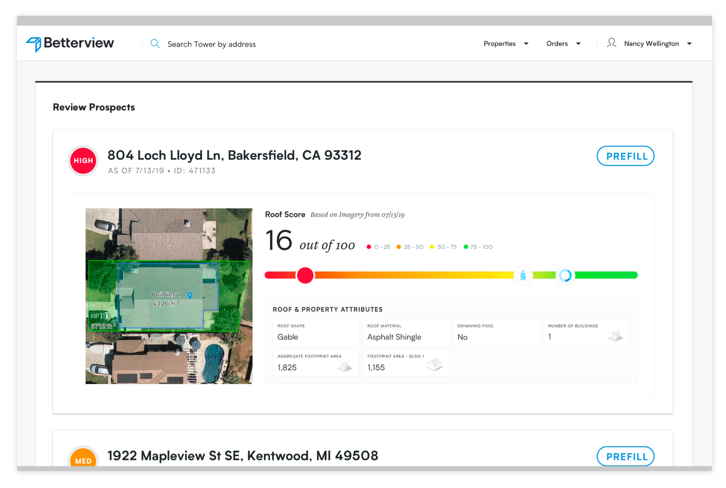

Betterview’s predictive analytics for buildings and properties uses proprietary computer vision, machine learning and data science to help predict the likelihood of a claim on residential and commercial roofs.

“Nationwide recognized the potential of Betterview’s insights around roof imagery and the data stream that flows from their machine learning platform, which is why we made our initial investment last year,” said Eric Smith, senior vice president of Commercial Lines at Nationwide. “This three-year agreement will enable us to add Betterview’s predictive analytics into our underwriting operations. Going forward, we’ll be able to leverage our underwriting expertise and talent where it is needed most – on higher-value, more complex accounts.”

Nationwide’s relationship with Betterview began in May 2018 with its initial venture capital investment. The insurance and financial services company later followed up on that investment by participating in Betterview’s Series A round along with ManchesterStory, EMC Insurance, Maiden Re, and Compound.

Since the release of its risk management platform and predictive analytics last year, Betterview has worked with many P&C insurance company customers, from top ten to small regional carriers.

“We are proud that Nationwide not only saw the value of our predictive analytics to help the P&C insurance industry as a whole but also in applying it to their business to improve their underwriting operations,” said David Lyman, CEO & Co-Founder, Betterview.

“Over the last few months, we have allocated many resources to scale our data science and engineering teams to launch an instant roof risk score and generate insights about each building that is located inside a parcel boundary,” added David Tobias, Betterview COO & Co-Founder. “We are looking forward to working alongside Nationwide to implement our data and analytics into other areas so we can help them provide next-generation experiences to their customers.”

Armin Monajemi

Armin Monajemi