On the heels of a successful evaluation of Betterview’s predictive analytics for roofs and buildings, Frederick Mutual Insurance Company today announced a commercial agreement with Betterview.

Based in Frederick, MD, Frederick Mutual Insurance Company has been in business for 175 years and is the ninth oldest insurer in the United States. Through independent agents, the company offers comprehensive insurance coverage and products for small businesses located in Maryland, Delaware, Virginia, Pennsylvania, North Carolina, and Washington, D.C., as well as homeowners insurance in Maryland and Pennsylvania.

Betterview and Frederick Mutual first met in the spring of 2019 at the AM Best Review and Preview Conference. Within 45 days of their initial meeting, Betterview’s predictive analytics was being used in a production environment.

“We may be one of the oldest insurance companies in the United States, but we are a forward-thinking organization that acts like a 175-year-old startup,” said Nancy Newmister, President and Chief Executive Officer, Frederick Mutual. “When I was appointed CEO of Frederick Mutual three years ago, the goal was to position the company for sustainable profitable growth. Our focus was to price accounts with greater accuracy, underwrite high-quality properties, as well as improve the accuracy and handling of our claims. To accomplish these goals, it was vital for us to understand what we are insuring, along with uncovering what caused specific claims. Betterview’s building & property data and analytics, along with its historical imagery and address specific peril information, allowed us to gain a better understanding of risk, whether it was underwriting new business or determining the cause of a claim for reinsurance purposes,” explained Newmister.

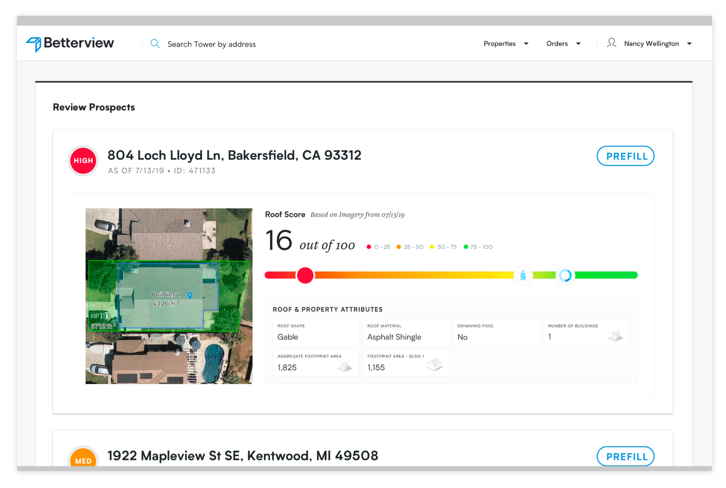

Since its release in August of last year, Betterview’s property risk management platform is already being used by over a dozen personal lines and commercial lines carriers to identify and score roof condition and other property risks. Frederick Mutual plans to use Betterview’s property analytics throughout the policy lifecycle, from loss control and underwriting to claims and catastrophe response.

For more information, please refer to our press announcement or contact Paul Ptashnick at paul@betterview.com