Betterview, which is quickly becoming the platform essential to every transaction around buildings and properties, today announced a commercial agreement with Frederick Mutual Insurance Company. The terms of the agreement were not disclosed. Frederick Mutual plans to use Betterview’s property analytics throughout the policy lifecycle, from loss control and underwriting to claims and catastrophe response.

Based in Frederick, MD, Frederick Mutual Insurance Company has been in business for 175 years and is the ninth oldest insurer in the United States. Through independent agents, the company offers comprehensive insurance coverage and products for small businesses located in Maryland, Delaware, Virginia, Pennsylvania, North Carolina, and Washington, D.C., as well as homeowners insurance in Maryland and Pennsylvania.

“We may be one of the oldest insurance companies in the United States, but we are a forward-thinking organization that acts like a 175-year-old startup,” said Nancy Newmister, President and Chief Executive Officer, Frederick Mutual. “When I was appointed CEO of Frederick Mutual three years ago, the goal was to position the company for sustainable profitable growth. Our focus was to price accounts with greater accuracy, underwrite high-quality properties, as well as improve the accuracy and handling of our claims. To accomplish these goals, it was vital for us to understand what we are insuring, along with uncovering what caused specific claims. Betterview’s building & property data and analytics, along with its historical imagery and address specific peril information, allowed us to gain a better understanding of risk, whether it is underwriting new business or determining the cause of a claim for reinsurance purposes,” explained Newmister.

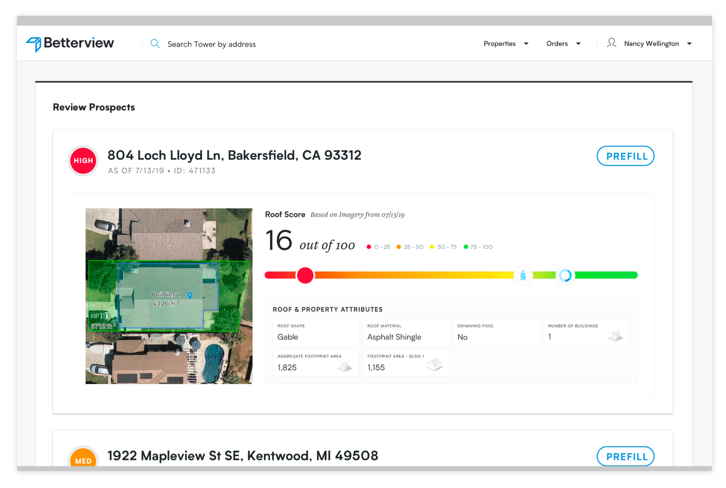

Betterview’s property risk management platform is used by over a dozen personal lines and commercial lines carriers to identify and score roof condition and other property risks. Betterview does this by using machine learning and computer vision to analyze manned aircraft and satellite imagery. Betterview then combines this data with building records and historical weather to determine the characteristics and condition of a roof and the risk of a future loss.

“It really has been an amazing journey with Frederick Mutual so far. Within a span of 45 days, we went from meeting at an industry conference to having our predictive analytics used in a production environment,” said David Lyman, CEO & Co-Founder, Betterview. “Since that time, we have seen the use cases of our predictive analytics and risk management platform evolve at Frederick Mutual, which has played a role in Frederick Mutual’s positive growth, and more importantly, enhanced the company’s communications with agents and customers by identifying potential issues before they turn into a loss,” said Lyman.

Armin Monajemi

Armin Monajemi