How to Tackle P&C Rating in 2024

How can insurers rate more effectively when property condition across the US is changing more frequently than ever? This is a significant challenge ...

Over the last several years, it has become apparent that property intelligence is a highly valuable resource for P&C insurance companies. It empowers insurers to maximize efficiency and improve profitability throughout the policy lifecycle, particularly during new business underwriting and renewal underwriting. But in order to truly meet the needs of insurance professionals, property intelligence providers need more than just high-quality data. They need to meet underwriters where they are – and the best way to do that is through the framework of COPE.

A well-known concept for underwriters, COPE of course stands for Construction, Occupancy, Protection, and Exposure. Underwriters have used this framework for decades to work efficiently, getting a complete view of real property risk. For this reason, it makes sense for insurtech companies serving underwriters to also adopt this framework when building their own risk management tools. By aligning their own product with COPE, insurtechs respect the time and expertise of experienced insurance professionals. In order to better understand how COPE supercharges underwriting speed and accuracy – and why insurtech companies should adopt it as a framework – let’s dive deeper into each of the components of COPE data.

Construction

Construction refers to both the materials used to construct a building, as well as its overall physical condition. Datapoints that fall under Construction include the shape, material, and age of a roof, as well as any staining, ponding, or other roof maladies impacting overall condition. The presence of a secondary structure on a property would also fall under Construction.

The first element of COPE, Construction is also one of the most expansive categories of property intelligence. Using high-quality aerial imagery, computer vision models, and third-party data sources, a strong property intelligence platform can tell underwriters every detail of building construction without the need for a physical inspection. This information is invaluable for properly pricing risk and avoiding premium leakage, predicting and preventing future claims, and reducing underwriting expenses.

Occupancy

Occupancy refers to who, if anyone, is currently occupying a building, whether they are owners or renters, and how the building is being used. Sources of Occupancy data include zoning information, postal service data, and other third-party providers who may also have information on the occupancy of surrounding buildings.

Like Construction, property intelligence related to Occupancy is highly relevant for underwriters to determine the appropriate level of risk for a property and price the policy accordingly. A property zoned for commercial use, for example, will carry significantly different risk than one zoned for single-family residential use or one that is being rented to multiple tenants. Underwriters need to know about Occupancy, and any reliable property intelligence platform should take this into consideration.

Protection & Exposure

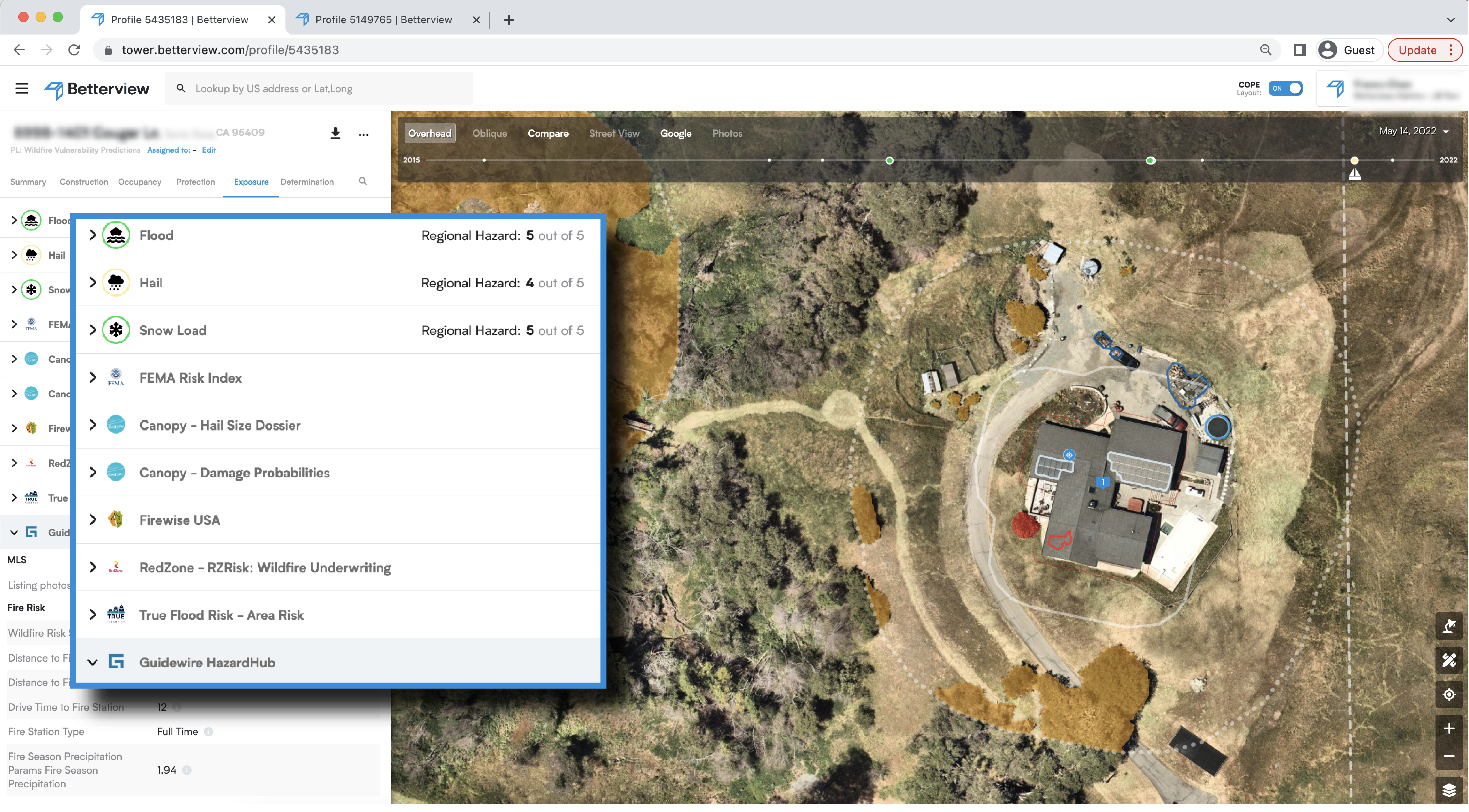

Protection refers to any safety resources or other factors nearby a property that help to reduce risk. Examples of property intelligence related to Protection might include how many fire hydrants are near a property, the distance to a fire station, and even community-level certifications such as FireWise by NFPA. Exposure, on the other hand, refers to external factors that increase the overall risk of a property. A lack of defensible space, for example, would increase a property’s overall wildfire risk. A damaged roof, on the other hand, might present risks during hurricane season.

Strong property intelligence platforms synthesize Protection & Exposure data into peril-specific risk scores. Betterview and Guidewire/HazardHub, for example, have combined vulnerability and hazard data to create a single, reliable Hail Claim Predictor. With actionable scores like these, underwriters can confidently evaluate the Protection & Exposure profile of a property. This allows insurers to expand their business in hazard-prone regions, and even work together with agents and policyholders to proactively mitigate risk and avoid future claims.

COPE and the Future of Smart Underwriting

COPE is a popular framework for underwriters and for good reason. Taken together, these four categories tell you everything you need to know about the overall risk of a property. The only problem is that, in the past, underwriters were not given all of this information in a single place. Even when they did have access to property data, it was scattered across multiple, incompatible platforms.

The rise of remote property intelligence means that relevant data is more accessible than ever. Data providers shouldn’t stop at accessibility, however: they must curate disparate sources of property data into a single, proven framework, and the name of that framework is COPE. By organizing their User Interface around COPE at the highest level, property intelligence companies can deliver a tool that actually meets the needs of underwriters. Additionally, it makes their jobs easier and doesn’t bury them in unstructured data.

If P&C underwriters are given high-quality data using this framework, they will be empowered to identify risk attributes and loss exposures, underwrite policies with speed and accuracy, and proactively mitigate risks with policyholders. If they embrace COPE today, the property intelligence industry can truly revolutionize P&C insurance.

How can insurers rate more effectively when property condition across the US is changing more frequently than ever? This is a significant challenge ...

Property reinsurance rates are at their highest in 17 years. Factors such as shifting weather patterns, record losses, and economic uncertainty have...

The right peril data makes a tremendous difference for P&C insurers – especially as states like Florida and California introduce new regulations...