Betterview Launches Defensible Space Feature

As part of Betterview’s Property Intelligence Platform the new feature makes it easier for insurers to identify structures where potential hazards...

3 min read

Meadow Green

:

Feb 1, 2022 11:26:05 AM

Meadow Green

:

Feb 1, 2022 11:26:05 AM

Betterview is pleased to announce a brand new feature to our Remote Property Intelligence Platform. With the launch of our new Defensible Space Map and Score, Betterview now offers insurers the strongest and most transparent view of wildfire, wind, and hurricane vulnerability for their entire book of properties.

According to The California Department of Forestry and Fire Protection, Defensible Space refers to “the buffer you create between a building on your property and the grass, trees, shrubs, or any wildland area that surround it.” As wildfires, hurricanes, and other catastrophic events have worsened in recent years due largely to the effects of climate change, understanding and maintaining Defensible Space has become a high priority for P&C insurers. In order to best understand and mitigate risk, insurers need a solution that gives them a holistic and transparent view of Defensible Space. Only by achieving this view can insurers and their insured work together to reduce damage and save lives.

Betterview’s new Defensible Space Map is that solution. We start with the high-quality aerial imagery that drives all of the actionable insights on our platform. That imagery is processed by our proprietary Machine Learning algorithms, which return a comprehensive map of Defensible Space for every structure on a property. The map analyzes the three zones of Defensible Space as defined by many Western states:

Within each of these zones, the Betterview platform analyzes for encroaching vegetation, yard debris, roof debris, and additional structures. A map is created of the total amount of defensible space for each building and an aggregate for the entire parcel. This map clearly shows each attribute contributing to or detracting from Defensible Space. In addition to the map, the platform also now features a Defensible Space Score, which grades each structure’s overall vulnerability to catastrophic damage.

Betterview’s Defensible Space features are backed up by numbers. Results so far indicate that a property without any defensible space, regardless of what zone it lies in, is 2x more likely to experience fire damage. In addition, properties with 75% more defensible space in Zone 2 (30-100 feet from the building) are 1.6x more likely to survive a wildfire completely undamaged.

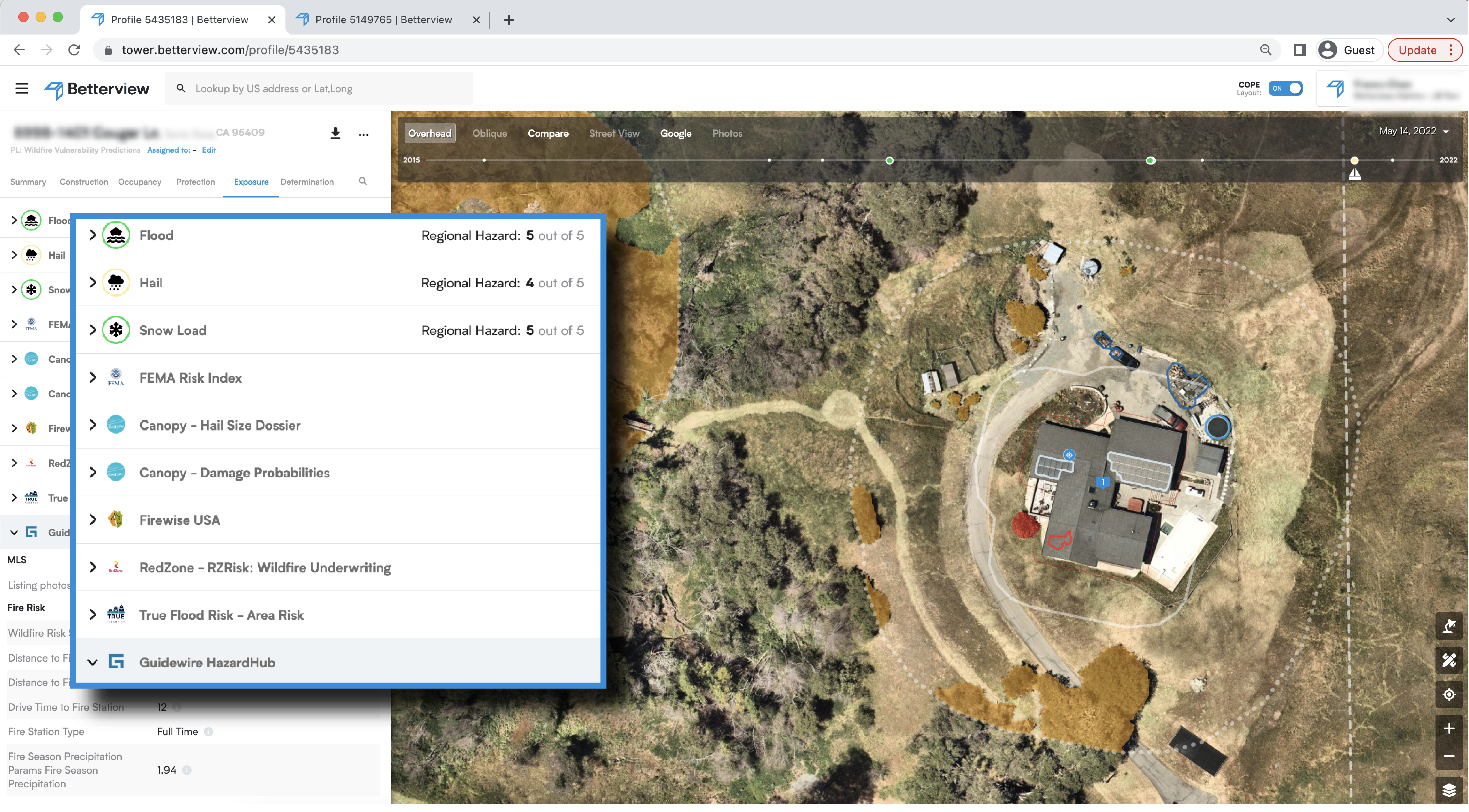

The strongest feature of the Betterview platform is how it synthesizes multiple sources of property data to empower direct underwriting action. Our approach to wildfire, wind, and hurricane risk is no different. In addition to the Defensible Space Map and Score, users also have access to a wealth of third-party intelligence on PartnerHub. Featuring such trusted companies as RedZone, Black Swan, and HazardHub, PartnerHub allows users to augment Betterview’s building-level analysis with regional wildfire intelligence. The combination of these two features gives users a holistic, transparent, and actionable view of real wildfire risk.

Betterview is certainly proud of how our platform helps insurers improve their expense ratio. But when it comes to maximizing Defensible Space, our primary concern is not the bottom line. Instead, our main focus is on preventing damage and saving lives. The Defensible Space Map and Score are designed with these goals in mind: to predict and prevent losses, and to keep homeowners safe. That is why we encourage insurers to share our Defensible Space insights with their insured in custom reports, and to work with them to make sure they are as safe as possible. After all, what is the true purpose of insurance, if not to foster security, safety, and peace of mind?

Working in a space as dynamic as P&C insurance, the team at Betterview knows the importance of constantly innovating. The Defensible Space Map and Score represent a major new feature to the Betterview platform, one that improves our users’ ability to predict and prevent losses. We are proud to unveil this latest improvement to our users, furthering our mission of solving relevant insurance problems with cutting-edge, action-driven solutions.

To learn more about how Defensible Space can impact your business, and to see the feature in action, book a demo today!

As part of Betterview’s Property Intelligence Platform the new feature makes it easier for insurers to identify structures where potential hazards...

In an article written in collaboration with the Insurance Thought Leadership, “How to Cruise Through the New Florida Property Insurance Legislation”,...

The right peril data makes a tremendous difference for P&C insurers – especially as states like Florida and California introduce new regulations...