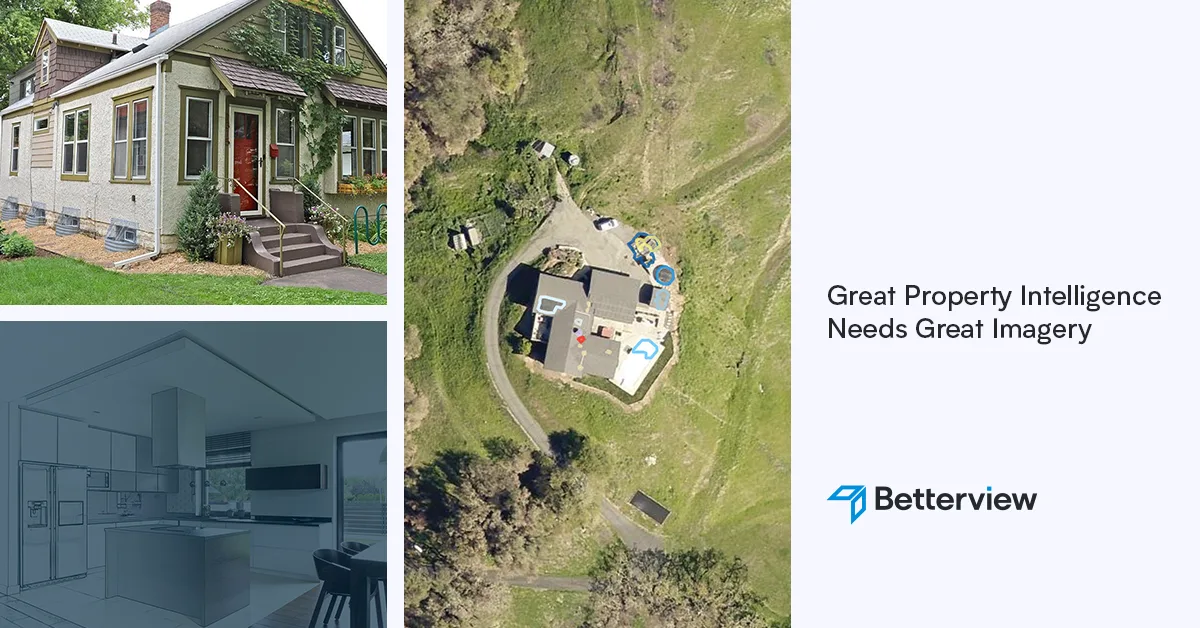

Great Property Intelligence Needs Great Imagery

To manage risk and build resilience, P&C insurers need accurate property imagery. It'sa crucial componentof aneffective property intelligence toolkit...

Every year I play golf, breaking 100 gets a little more difficult. Gone are the days when my score sat comfortably in the 80s and 90s. Everything, it seems, is getting more challenging: courses are getting longer, my competition is getting better, and I have become more limited by my own abilities due to a loss of flexibility and range of motion.

Property insurers are facing similar problems in underwriting, risk management, and loss control today. Writing business comfortably with standard pricing and T&C’s is not as simple as it once was because the game has changed. Given a more challenging environment, breaking 100 on combined ratio is no longer a sure bet for P&C insurers. Changing weather patterns, inflation, and a more competitive market have created significant obstacles to profitability.

So what steps can I take to improve my game, and what can insurers do to improve theirs? Part of the answer lies in new tools and technologies. In that respect, I believe property insurance is going through a similar revolution that golf went through in the late 1970s. During that time, TaylorMade revolutionized the game by introducing the first metal wood driver. Technology fundamentally changed the capabilities of the average golfer by creating a longer, straighter, and more forgiving way to play the game.

New trends in insurance technology have given P&C carriers their own version of the metal wood driver. Geospatial imagery, computer vision models, and predictive analytics (like the ones housed in the Betterview platform) transform the way that insurers analyze and manage risk for their book. When properly integrated into existing workflows, these technologies can transform insurers from repair and replace to predict and prevent. Inspections and underwriting processes are optimized and losses are avoided, driving down combined ratios. Any insurer interested in improving their game needs to consider investing in this new generation of equipment.

Another surefire way to improve your golf game is to seek help from other experts. I resisted taking lessons for a long time, stubborn in my belief that I didn’t need them – I could get around the course just fine without dedicating the extra money or time. But when I saw how much my friends’ games improved after taking lessons, I knew I needed to follow suit or fall behind.

Insurers, too, can benefit from learning new strategies from partners in the industry, no matter how long they have been in the game. This doesn’t mean that the old way of doing things is outmoded; I still retain the fundamentals from when I first started golfing. But as the industry continues to change, it would be counterintuitive not to evolve alongside it.

Companies that understand this, and who adopt new risk management strategies built on predictive analytics, tend to improve their game. On average, insurers who implement Betterview’s platform and adopt a predict and prevent model to risk management have improved their combined ratio by 7%. If I found an expert guaranteed to cut seven strokes off my golf game, I know I would follow any advice they gave me. In this sense, Betterview is the ultimate caddie for insurers.

There is something to be said for the similarities between golf and property insurance. Both, after all, deal extensively with water hazards. And in both fields, experienced players can always benefit from adopting a fresh approach to new challenges. While Betterview hasn’t helped my golf game yet, I am confident it can empower insurers to improve their ratios, prevent avoidable losses, and better engage with their insured. To learn more about how Betterview can help your company succeed, reach out and request a demo today.

To manage risk and build resilience, P&C insurers need accurate property imagery. It'sa crucial componentof aneffective property intelligence toolkit...

In an article written in collaboration with the Insurance Thought Leadership, “How to Cruise Through the New Florida Property Insurance Legislation”,...

When Betterview launched the Roof Agesolution in April 2023—the first of its kind—it sparked a new wave of insurtech product innovation and risk...