West Bend Mutual Selects Betterview for Underwriting and Loss Control

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce the...

1 min read

![]() Betterview

:

Apr 12, 2022 8:00:00 AM

Betterview

:

Apr 12, 2022 8:00:00 AM

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce Vermont Mutual Insurance Group (Vermont Mutual) has selected the Betterview Property Intelligence & Risk Management Platform to help strengthen underwriting processes for the company’s commercial lines business.

Chartered in 1828, Vermont Mutual has provided a range of coverages across seven states in New England and the Mid-Atlantic region for nearly 200 years. As one of the oldest P&C insurance companies in the U.S., Vermont Mutual has earned a reputation for security and reliability and an A+ rating from A.M. Best. Vermont Mutual has continuously looked for innovative solutions which would enable more accurate underwriting and greater profitability across the company’s book of business.

“The Betterview platform gives us a view of property condition – in particular roof condition – that is both comprehensive and actionable,” says Jonathan Becker, VP of underwriting at Vermont Mutual. “The more we know about a property before sending an inspection team, the more we can optimize that entire process. These tools are going to be indispensable in providing value to our clients and in better understanding risk.”

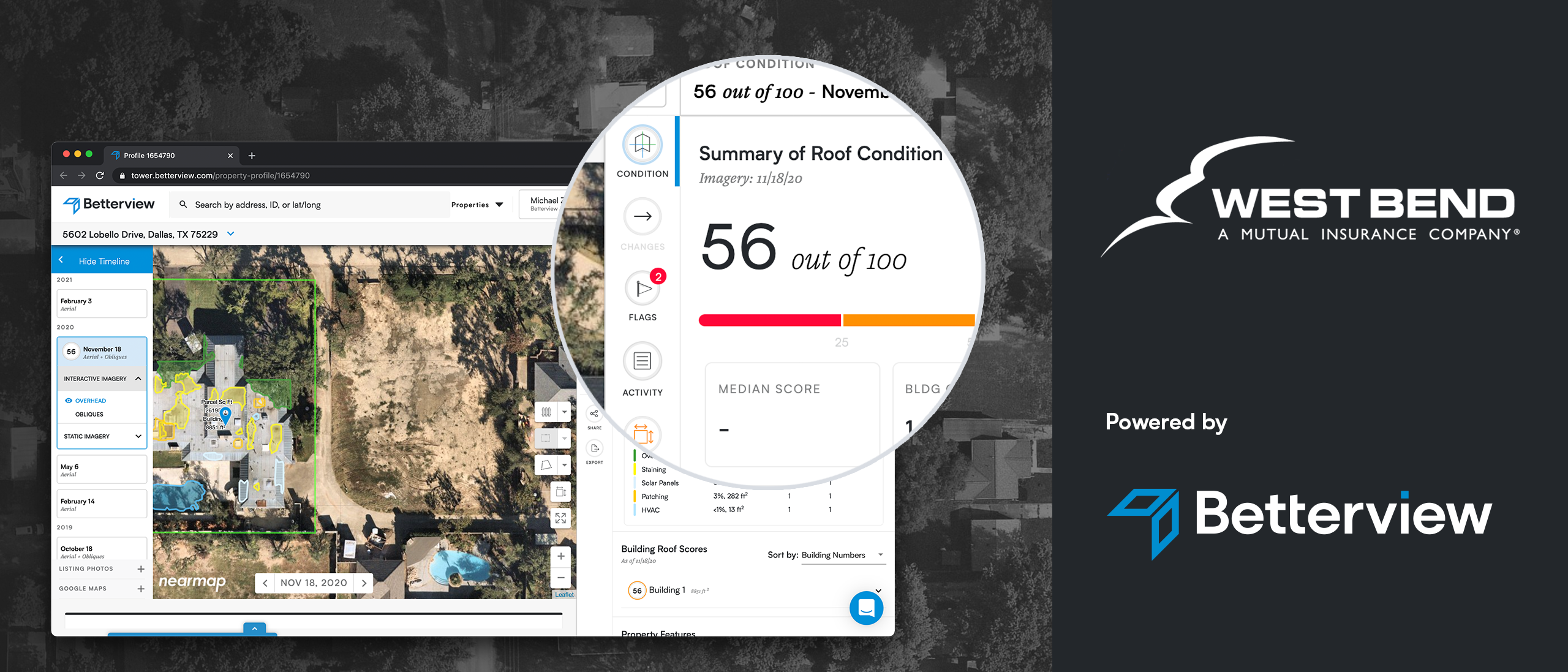

Founded in 2014 by insurance industry veterans, Betterview helps insurers better predict and prevent losses, streamline underwriter efficiency, and engage with customers. Betterview's Property Intelligence & Risk Management Platform includes tools which utilize geospatial imagery, computer vision models, and trusted third-party data from the company’s vendor marketplace, PartnerHub. Already, Vermont Mutual’s underwriters are using the platform to order risk reports on commercial properties during the underwriting process.

“The insights on our platform are designed to help companies, like Vermont Mutual, succeed in a new era of property and casualty insurance,” said Neil Weiss, sales director for Betterview. “It’s no longer enough to be reactive towards claims, repairing and replacing after damage occurs. Instead, we hope that our tools will instill a predict and prevent mindset in the underwriters at Vermont Mutual, allowing them to anticipate losses and take action based on real risk drivers.”

“We are thrilled to be working with a company which has as impressive a legacy as Vermont Mutual,” said David Tobias, co-founder and COO for Betterview. “We can’t wait to see our property intelligence tools help them succeed for another generation to come.”

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce the...

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce that...

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce that