Co-operative Insurance Selects Betterview

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce that...

1 min read

![]() Betterview

:

Oct 18, 2021 8:49:44 AM

Betterview

:

Oct 18, 2021 8:49:44 AM

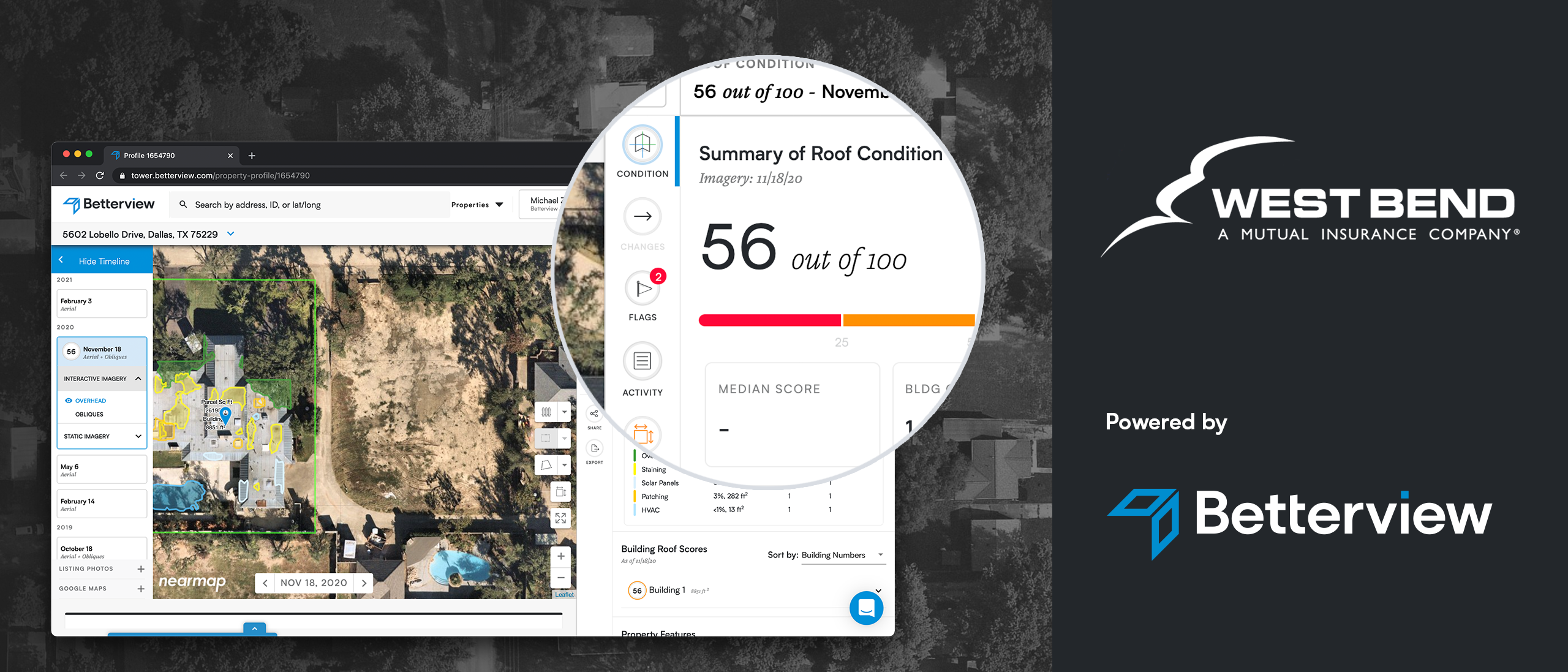

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce the company’s Remote Property Intelligence Platform has been selected to improve the underwriting and loss control capabilities for West Bend Mutual Insurance (West Bend Mutual).

Based in West Bend, Wisconsin, West Bend Mutual has provided personal and commercial P&C coverages to customers in 15 states for more than 125 years. West Bend Mutual’s selection of Betterview as part of a large scale underwriting and claims modernization initiative will leverage Betterview’s Remote Property Intelligence Platform, including the integrated PropertyInsight tool and Roof Spotlight Index, to efficiently evaluate its entire book of commercial properties for new business and renewal.

“Betterview stood out for their ability to not only analyze risk, but to treat us as a partner,” said Adam Vander Weert, manager of product management for West Bend Mutual. “They are constantly asking for feedback to tailor and improve their tools to fit our needs. We can now quickly and accurately assess roofing quality as a data point in our property underwriting process.”

Betterview’s Platform, in particular the company’s PropertyInsight tool, delivers a rich set of data and insights on property conditions which, when combined with third-party data, can trigger rules and promote action to improve risk. Alongside the Roof Spotlight Index, the PropertyInsight tool allows West Bend Mutual to determine which properties can be fast-tracked to renewal, and which require further attention or even an on-the-ground inspection.

Founded in 2014 by insurance industry veterans, Betterview uses a combination of third-party data, geospatial intelligence, and proprietary machine learning (ML) tools to provide an accurate assessment of a property’s real risk drivers. The Betterview Platform, including the Roof Spotlight Index, a 100-point assessment of a roof’s condition, and its integrated rules and flagging engine make it easy for underwriters to take direct actions in order to prevent future losses and improve loss ratios.

“By combining Betterview’s proprietary, ML-driven property insights, as well as third-party data, insurers like West Bend are able to take decisive next steps at every stage of the policy lifecycle,” said David Tobias, co-founder and chief of operations for Betterview. “We look forward to a long and productive relationship with West Bend Mutual.”

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce that...

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce ...

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce that...