Betterview Announces Partnership with OneShield

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce a...

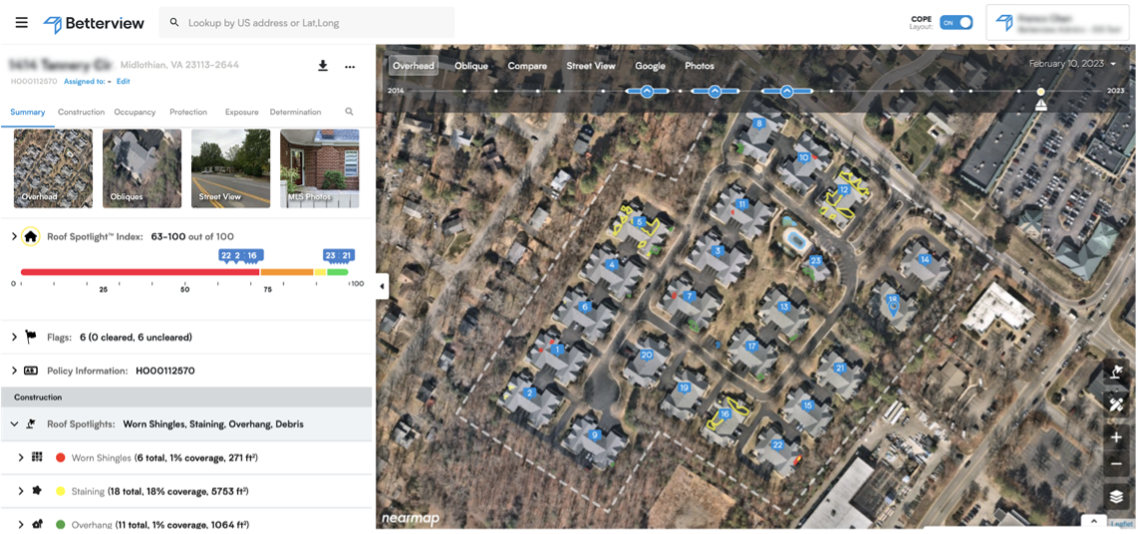

Betterview is proud to announce a major update to our property intelligence platform’s user interface (UI). The third generation of our analytics UI brings together every piece of data users need to know about a property into a single screen. The information is well-organized, and the experience is responsive to interaction. This release enhances our existing features – best-in-class flagging system, continuous property monitoring, and Partner Connect geospatial data integrations– along with the latest advances in computer vision and generative AI.

We understand the complex business needs of insurance companies, so we built a single platform to serve all lines of business, from personal lines to commercial lines and everything in between. Our UI sets the standard for property intelligence, transforming accurate, richly sourced property data into comprehensive risk insights for insurers.

Our UI is now organized around the COPE framework (Construction, Occupancy, Protection, and Exposure) following extensive feedback and user sessions from thousands of underwriters. COPE is an industry standard used by insurance underwriters to evaluate and assess the risk associated with insuring a particular property or business. The new layout organizes key risk indicators into this industry standard framework to streamline and prioritize the most relevant data for rapid and accurate underwriting decisions.

The Betterview UI is fully customizable. When onboarding, customers work with our value consulting team to tailor the platform to their needs, setting up custom business rules in our flagging system. For every line of business, from high-volume residential to high-touch commercial, our UI is custom tailored to optimize the underwriting process.

Pin building permits and related business information in the summary when writing commercial property to quickly assess potential risk for each individual business. Add crime and occupancy data when writing homeowners' policies. Any data point you need fast is right at your fingertips.

The new timeline view allows users to seamlessly toggle between different imagery sources and see important insights in a single glance. This flexible approach empowers underwriters to see property condition and risk easily from every possible angle. Sources include:

Underwriters can easily compare any two historical images side-by-side. With our enhanced comparison tool, easily view roof score changes, spotlight changes, peril risk increase or any change over time.

Our updated UI presents the industry’s best property insights in easy-to-understand visualizations. New, data visualizations in the UI refresh include:

Our new UI is highly adaptive and interactive to manage peril risk, highlighting relevant risk drivers like defensible space and tree fall risk, and featuring risk scores and claim predictors for wildfire, hurricane, wind, hail, and other risks. Our approach considers both regional hazard and property-specific vulnerability, giving insurers everything they need to dive deeper and proactively address peril risk.

Data validation is crucial given the vast amount of property data available on our platform. Our new UI displays and compares different data sources, including internal policy information, third-party property data, application data, and our own computer vision detections. This transparent view enables insurers to easily verify data accuracy and move forward with confident policy decisions.

Partner Connect, our third-party marketplace of curated property data, is easily navigable through our new global search function. Access thousands of data points from industry-trusted providers to expose risk, reveal potential future losses, and recommend mitigation steps to policyholders. You can also pin these insights to your Summary tab for easy future reference.

Betterview continues to raise the bar for actionable and accurate property intelligence. This 3rd update to our UI continues our mission to reveal the most important insights for insurers and spotlight key risk drivers for faster decisions and underwriting. Enjoy a better view of every property with the latest update to the Betterview Property Intelligence and Risk Management Platform.

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce a...

1 min read

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce the...

Betterview, an InsurTech provider of actionable property intelligence to property and casualty (P&C) insurance companies, is pleased to announce ...