Is Transparency the Next Insurance Innovation?

Despite its enormous social and economic significance, the P&C insurance industry continues to face challenges with its reputation and individual...

3 min read

David Lyman

:

Aug 17, 2020 1:20:01 AM

David Lyman

:

Aug 17, 2020 1:20:01 AM

What do incumbent insurers need to fear—or learn—from InsurTech distributors? Investment continues to pour into leading companies such as “unicorn” startups Lemonade and Hippo. Renters’ insurer Lemonade’s July 2 IPO raised $319 million, and Hippo—which sells homeowners’ insurance—raised $150 million in a Series E funding round. Both startups represent a new standard of customer experience for insurance buyers that the industry is watching closely. However, Hippo stresses what may be a much more important area of change and disruption for incumbents: the insurer/policyholder partnership in risk management.

Since the early days of the Internet, it was clear that a quick, easy and pleasant purchasing experience would eventually be table stakes for all consumer-facing businesses. Insurers face special challenges in delivering that experience because of the complexity of both their products and their systems environments, but customer experience remains a horizontal function. Insurers that deliver a better experience undoubtedly have the opportunity to win new customers and—if that experience extends beyond purchase to claims—to retain them. Working with policyholders to prevent losses goes beyond customer experience into customer relationship and beyond the horizontal into the realm of concerns at the very heart of insurance.

Hippo is a leading example of a homeowners insurance provider that has been taking a proactive approach to the mutually beneficial goal of preventing losses. The company serves as a partner in risk management by identifying risk factors and providing insureds an easy path to mitigate the risks before they lead to increasingly costly losses. Proactive risk management can be likened to a car owner being encouraged to make ongoing oil changes to avoid the much more costly and disruptive eventuality of an engine rebuild. A small dose of upfront maintenance greatly reduces the chance of a really bad future outcome.

The proactive risk management approach itself is not new to property insurance—it’s essentially the commercial lines loss control concept that my co-founder, Dave Tobias, knows extremely well from his history of running his family’s insurance inspections business. However, proactive risk management has traditionally been too costly to scale this approach across all property insurance policies using traditional business processes and technology. For a homeowners policyholder, removing debris from a property, creating defensible space, or even replacing a roof is far cheaper and less disruptive than suffering a fire or water penetration that not only causes building damage but also destroys personal belonging, displaces inhabitants, disrupts business activity, or, in the worst case scenario, causes bodily harm. New technology is now available that enables carriers to easily and cost-effectively identify and work with their insureds to mitigate conditions that are most likely to lead to a future catastrophe for them and their loved ones.

Hippo makes use of Internet of Things devices to proactively identify potential problems and address them throughout the life of the policy, as opposed to addressing potential problems only at the point of sale or when the policyholder files a claim. The company is developing a proposition that it is the policyholder’s partner in providing a solution for any problem related to homeownership.

Through this approach, Hippo shows the way not only to a better insurer to customer relationship, but also a way of adapting insurance’s value proposition to a changing world. Consider the fact that climate change is driving up the cost of remediating property losses faster than the rate of inflation. Too often, carriers respond by increasing premiums or simply dropping policies—for example in reaction to increased wildfire losses in California. The potential for data to drive greater insight into risk is increasing in leaps and bounds, but so is consumers’ fear that data and artificial intelligence will be used against them. The bad reputation of the insurance industry is partly because carriers are perceived to take advantage of their superior understanding of risk at the expense of the customer. Adopting a collaborative posture where the insurer transparently shares information and puts the policyholder in a position to affect the cost of their risk and reduce the likelihood of loss will help the insurance industry enhance its reputation with the public.

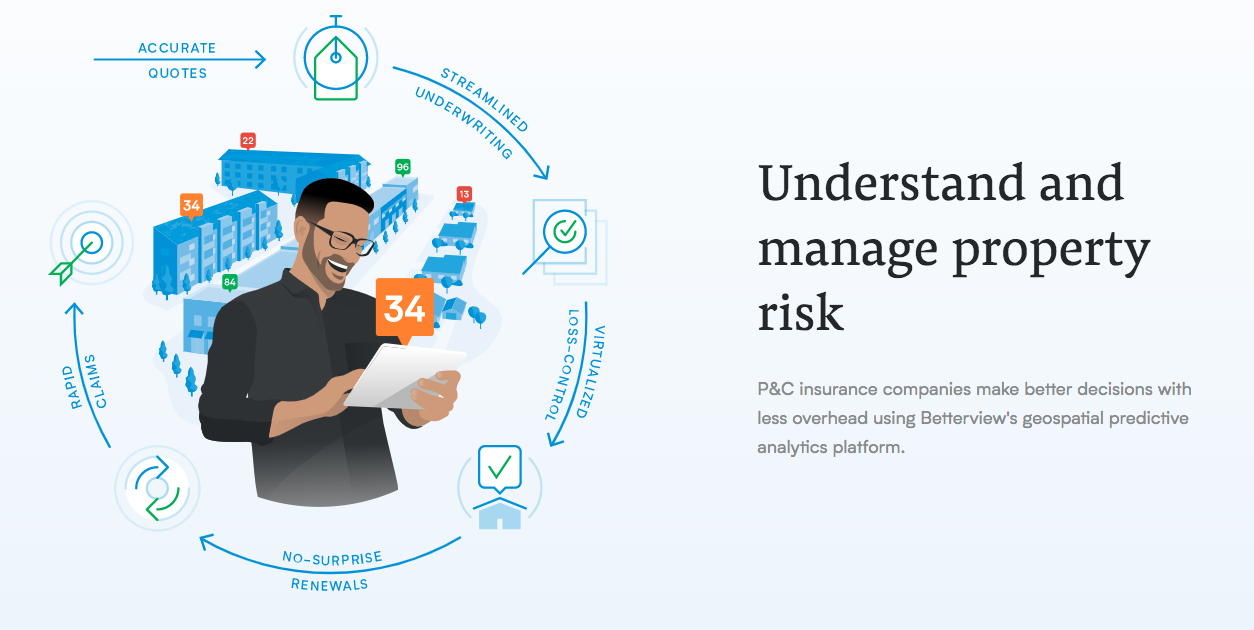

Betterview’s vision of insurance’s future for both homeowners’ and commercial property insurance is aligned with Hippo’s view. Our approach is to provide scalable, cost-effective technology to empower all carriers to become partners in risk management with their insureds. We built our platform, with a focus on visualization tools, to help insurers to share property risks with the agent and the insured to drive better outcomes for all parties.

Despite its enormous social and economic significance, the P&C insurance industry continues to face challenges with its reputation and individual...

Who owns the future of insurance? Following a year as tumultuous and unpredictable as 2020, the answer to that question is far from obvious. In a ...

An insurance company is a remarkably complex organization. Underwriters must write and renew policies for a book of potentially hundreds of thousands...