PartnerHub: Third-Party Property Intelligence Within the Betterview Platform

Betterview is proud to announce the launch of PartnerHub, the latest addition to our Remote Property Intelligence Platform. New and existing...

3 min read

Meadow Green

:

Nov 16, 2022 5:00:00 AM

Meadow Green

:

Nov 16, 2022 5:00:00 AM

When it comes to property intelligence, the “how” is just as important as the “what.” In other words, the channel through which an insurer consumes property intelligence matters just as much as the content of the property intelligence itself. A software platform can have the exact right tools and insights for a specific insurer’s use case; but if these tools and insights are not delivered in the most accessible format – requiring a minimal IT lift – they will be of little use. As a rule, property intelligence providers should offer a variety of data delivery methods tailored to the unique needs of different customers.

At Betterview, we understand the importance of flexibility in delivering our product to customers. We work with insurers of all shapes and sizes, from small regional carriers to massive companies that span the entire nation. Naturally, these different organizations will have different needs for their property intelligence solutions. Some may need immediate solutions for rapid pricing and quoting, while others are looking to monitor property condition over time and flag changes. Some may want a solution that includes all of the above. For this reason, we have adopted a strategy of omnichannel delivery. No matter their needs, every customer can consume Betterview property intelligence in an efficient and effective manner, without expending major IT resources.

Our team of engineers, data scientists, and designers has spent years developing our Property Intelligence & Risk Management Platform. Our existing customers have been proud of the work our team has done, especially the elegant and intuitive user interface (UI) they have built. However, our team is also aware that every customer has unique requirements for how they consume property intelligence. To best meet these needs, we offer a variety of ways to engage with our product. That is what we mean by omnichannel delivery.

All of these channels give users access to the same core product: the Betterview Property Intelligence & Risk Management Platform. So why use so many different channels? We believe in meeting our customers more than halfway. We know that every company faces different challenges, and every insurer has unique use cases for us to solve. That is why omnichannel delivery is essential and why it will always be a guiding principle here at Betterview.

Betterview is proud to announce the launch of PartnerHub, the latest addition to our Remote Property Intelligence Platform. New and existing...

How can we make life easier for underwriters? That question informs everything we do at Betterview. Not just because faster underwriting means lower...

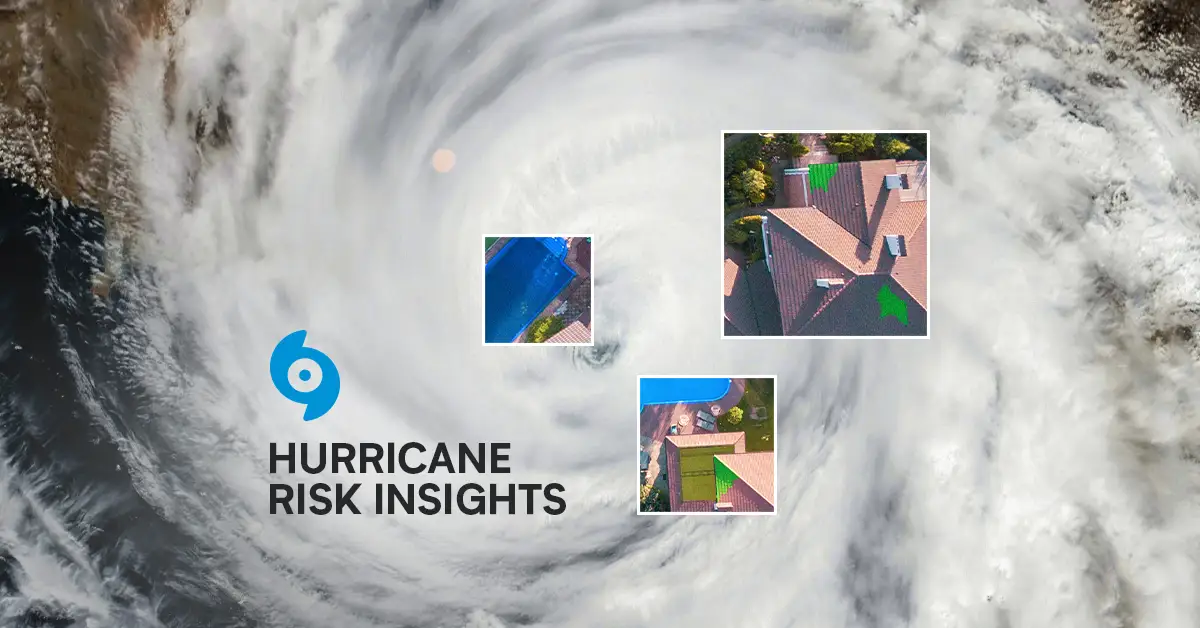

Insurers need comprehensive hurricane insights to protect customers and build resilience amidst increasing storm severity. Betterview has the answer:...