In case you missed it in the news, we wanted to provide a quick recap of Conifer Insurance Company’s recent partnership announcement with Betterview.

As part of this partnership, Conifer’s commercial lines underwriting team will be using Property Profile’s aerial imagery analysis to assist in the underwriting evaluation process.

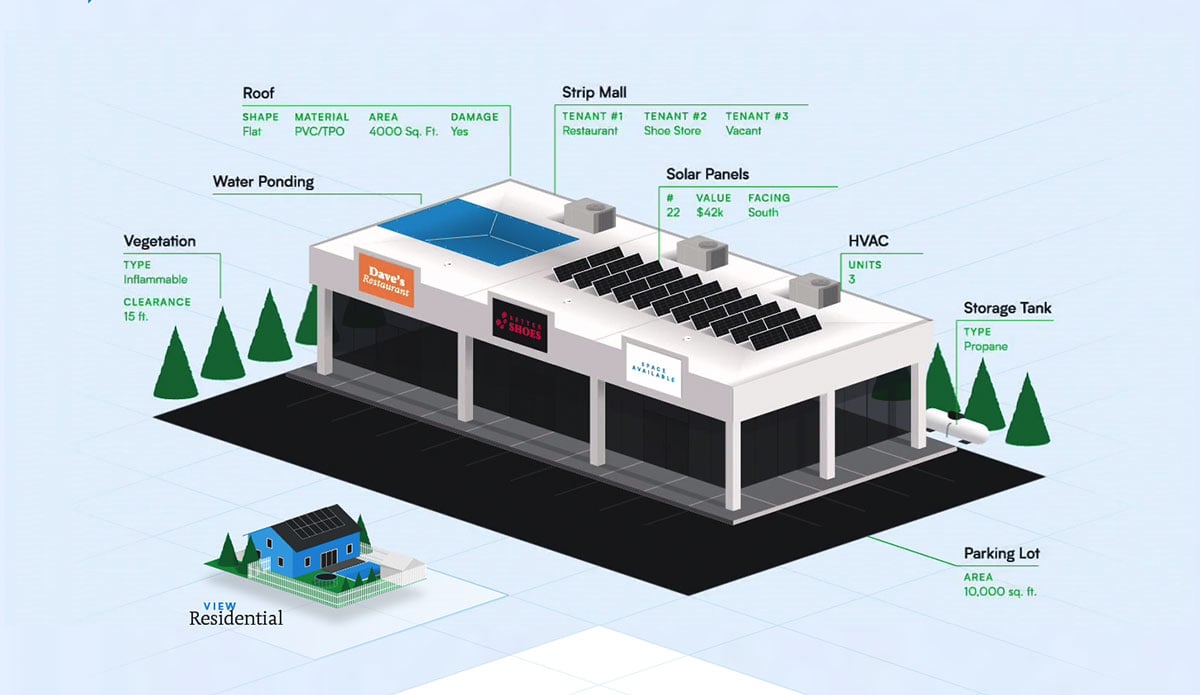

Property Profile has been specifically designed to meet the needs of commercial property carriers. Insurers like Conifer Insurance Company use Property Profile to identify and detect issues on various types of commercial roofs, such as black EPDM, white TPO, PVC, modified bitumen, SPF and more.

“We are always evaluating opportunities in the InsurTech space, especially if they can help us to mitigate risk or enhance our customer and agent relationships. One of the things that stuck out to us initially about Betterview was the commercial lines loss control experience of its Co-Founder Dave Tobias. This experience translated well during our proof of concept (POC) as Property Profile validated assumptions we already suspected about potential risk exposure in our book of business. We were very impressed with the final results of our POC and felt Property Profile’s unbiased analysis would be an effective communication tool when talking to insureds and agents about individual building and property risks.” – Nick Petcoff, President of Conifer Insurance Company.

Property Profile’s data & analytics may be accessed via API, Betterview’s Guidewire PolicyCenter™ integration or through Betterview’s risk management user interface.

For more information, please refer to our press announcement or contact email for details on our proof of concept program.

Related Posts