The Promise of AI in Underwriting

Artificial Intelligence (AI) has become increasingly important for modern P&C underwriters. AI tools and insights – particularly those which apply...

Making successful, long-term business decisions is largely a matter of reading trends, knowing how market demand is changing, understanding what features are emerging and which are obsolescent. However, from time to time events can suddenly clarify secular trends in either expected or counterintuitive ways. The emergence of COVID-19, popularly known as the Corona Virus, is such an event. The exposure created by the virus raises questions about the globalization of the supply chain while simultaneously validating its virtualization. From our perspective, it validates Betterview’s move toward virtualizing the human elements of the property inspection process.

The Coronavirus event has left nobody unaffected, as states have banned large gatherings of any kind, schools have canceled events and extended spring breaks. In terms of business routine, many meetings scheduled for the near future have been postponed or canceled, and companies have instituted very restrictive business travel rules. We’ve seen the astonishing developments of the effective quarantining of an entire country—Italy—and the suspension of travel from continental Europe to the United States.

Global electronic communications have revolutionized sourcing, making the location of partners functionally irrelevant. However, the COVID-19 pandemic underscores that while offshore delivery is virtual, the work is done by individuals who could be in a disease hotspot, threatening their availability through sickness, quarantine, or other factors affecting local infrastructure.

The most obvious answer to this business continuity exposure is to revisit redundancy, taking into account the probable impacts of pandemics. But another important lesson to glean is that for a process that can be entirely virtualized, the exposure to a pandemic or other events with the potential to harm workers is eliminated rather than just mitigated.

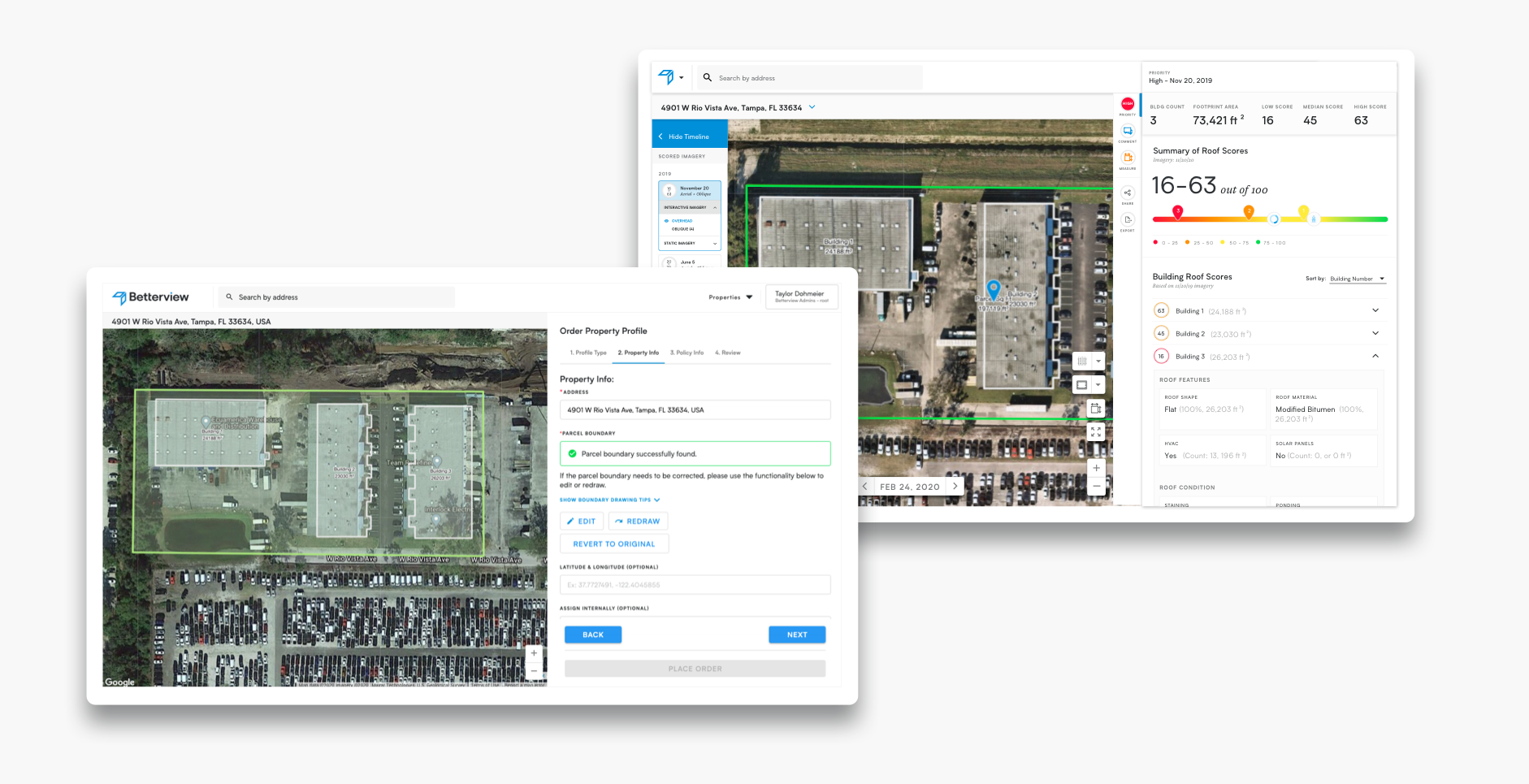

In mid-2019, Betterview virtualized its processes by leaving behind human-operated drones and instead shifting to high-quality imagery from satellite and fixed-wing aircraft to serve our customers’ needs. Of course, we didn’t have any premonition of a future pandemic; we chose a more virtual path for the usual reasons: speed, cost-efficiency, accuracy and, as a bonus, the elimination of human error.

The potential of technology combined with the never-ending search for efficiency has driven the virtualizing of many tasks, and on increasing levels of sophistication, as we’ve seen with physical robotics and RPA. As technology evolves, particularly in the area of artificial intelligence and machine learning, we will continue to see the advance of virtualization.

Occasionally some external factors will accelerate the process—such as $15 minimum wage laws driving self-service automation at fast-food restaurants. COVID-19/Corona virus is such an event, being a pandemic of greater impact, at least in terms of reaction, than any other disease since the 1918 influenza epidemic.

Our perspective on technology is about the advances that can be made through the combination of humans and machines. Our vision is one where people are empowered to do more meaningful, interesting and valuable work. That goes for property inspection as well as for underwriting tasks. There will always be a role for human property inspection, just as there will be for the art of underwriting. For property evaluation, technology is a tool for eliminating lower-value tasks and speedily collecting accurate information. It drives the human work up to a higher, less mechanical level. It also makes human work safer, whether from the dangers of climbing on a roof or from the unnecessary exposure to a contagious disease.

For more information on our virtual property inspections for residential and commercial properties, contact sales@betterview.com

Related Posts

Artificial Intelligence (AI) has become increasingly important for modern P&C underwriters. AI tools and insights – particularly those which apply...

Automation is a must have for P&C insurance companies, particularly for personal line carriers. It is essential for increasing underwriting...

P&C insurance companies are always looking for ways to improve their expense ratio, especially during unpredictable economic times. This means...